The DCF Valuation Methodology is Untestable

Harvard Corporate Governance

APRIL 20, 2022

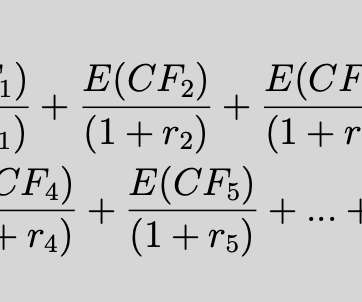

Posted by J.B. Heaton, One Hat Research LLC, on Wednesday, April 20, 2022 Editor's Note: J.B. Heaton is a managing member of One Hat Research LLC. The goal of discounted cash flow (DCF) valuation analysis is to answer the question, “What is this asset worth?” as in, what is the price that a rational person would be willing to pay for this asset in a competitive asset market.

Let's personalize your content