The Expanded Role of the Compensation Committee

Harvard Corporate Governance

AUGUST 3, 2022

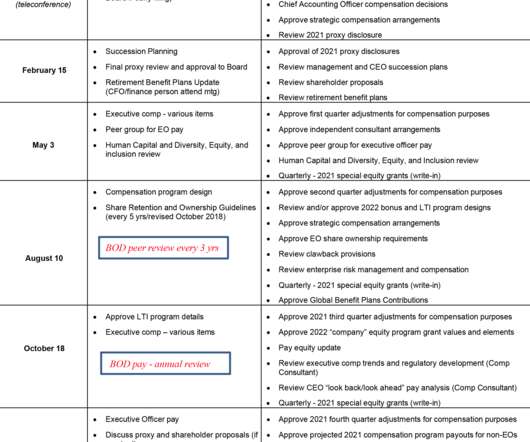

Posted by Ani Huang, and Richard Floersch, HR Policy Association, on Wednesday, August 3, 2022 Editor's Note: Ani Huang is President and CEO; and Richard R. Floersch is Senior Strategic Advisor at the HR Policy Association. This post is based on their HR Policy Association memorandum. The scope of the Compensation Committee continues to expand, especially in the areas of human capital management, talent strategy, and diversity, equity & inclusion (DEI).

Let's personalize your content