Sustainability in packaging: US survey insights

Mckinsey and Company

APRIL 26, 2023

Coming out of the pandemic, new realities are reshaping consumer attitudes on sustainable packaging in the United States.

Mckinsey and Company

APRIL 26, 2023

Coming out of the pandemic, new realities are reshaping consumer attitudes on sustainable packaging in the United States.

Harvard Corporate Governance

APRIL 26, 2023

Posted by Spencer D. Klein and Tyler Miller, Morrison & Foerster LLP, on Wednesday, April 26, 2023 Editor's Note: Spencer D. Klein is partner and Global Co-Chair of M&A practice and Tyler Miller is an associate at Morrison & Foerster LLP. This post is based on their Morrison & Foerster memorandum. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism (discussed on the Forum here ) by Lucian Bebchuk, Alon Brav, and Wei J

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Mckinsey and Company

APRIL 26, 2023

Generative AI is giving rise to an entire ecosystem, from hardware providers to application builders, that will help bring its potential for business to fruition.

Harvard Corporate Governance

APRIL 26, 2023

Posted by Patrick Bolton (Imperial College London) , Adrian Lam (University of Amsterdam) , and Mirabelle Muûls (Imperial College London) , on Wednesday, April 26, 2023 Editor's Note: Patrick Bolton is a Professor Economics and Finance, Mirabelle Muûls is an Assistant Professor in Economics at Imperial College London, and Adrian Lam is an Assistant Professor of Finance at the University of Amsterdam.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

NYT M&A

APRIL 26, 2023

The California health care organization will create a new nonprofit that aims to acquire a half-dozen additional community health systems.

Law 360 M&A

APRIL 26, 2023

The D.C. federal judge handling the U.S. Department of Justice challenge to Assa Abloy's $4.3 billion pickup of Spectrum Brands' hardware and home improvement business delivered a cryptic warning to the parties Wednesday during proceedings that were often closed to the public.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Law 360 M&A

APRIL 26, 2023

Getty Images has rejected a $3.95 billion takeover offer from activist investor Trillium Capital LLC, saying that without further details about why the $10 per share bid would benefit the business and shareholders, the status quo is the best path forward right now.

NYT M&A

APRIL 26, 2023

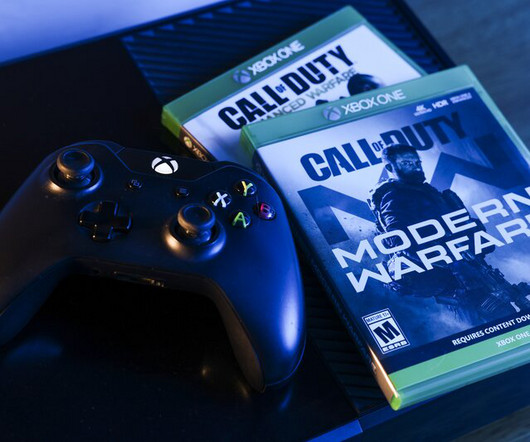

The decision barring the takeover of a big video game publisher is a major victory for proponents of regulating tech giants, which have faced obstacles in the United States.

Law 360 M&A

APRIL 26, 2023

Britain's antitrust authority said Wednesday that it has blocked Microsoft Corp.'s proposed $68.7 billion takeover of Activision Blizzard Inc. after finding that the deal could harm innovation and choice for U.K. players in the cloud-gaming market.

Avanade

APRIL 26, 2023

Low code no code applications are enabling nonprofit organizations to dynamically and quickly uncover new ways of doing things to improve impact and outcomes for beneficiaries.

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Mckinsey and Company

APRIL 26, 2023

Sid Sijbrandij, cofounder and CEO of GitLab Inc., on how the organization builds a cohesive culture and helps its team members thrive in a fully remote workplace.

Financial Times M&A

APRIL 26, 2023

Competition & Markets Authority says tech giant failed to meet concerns games would be exclusive to its cloud service

The Guardian M&A

APRIL 26, 2023

Competition and Markets Authority blocks what would have been biggest acquisition in gaming history The Call of Duty developer Activision Blizzard has accused the UK of being “closed for business” after the competition regulator blocked its attempted takeover by Microsoft, which would have been the largest acquisition in gaming history. The Competition and Markets Authority (CMA) prevented the $68.7bn (£55bn) cash purchase because of concerns it would squash the cloud gaming market, sparking fur

Business Wire M&A

APRIL 26, 2023

NEW YORK--(BUSINESS WIRE)--Stonepeak, a leading alternative investment firm specializing in infrastructure and real assets, today announced the successful completion of its previously announced transaction to acquire a 50 percent interest in KAPS, a Canadian natural gas liquids (“NGL”) pipeline system connecting Northwest Alberta to energy hubs in Edmonton and Fort Saskatchewan.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Law 360 M&A

APRIL 26, 2023

As a recent report on Justice Clarence Thomas' ongoing conflicts of interest makes evident, Supreme Court justices should be subject to an enforceable and binding code of ethics — like all other federal judges — to maintain the credibility of the institution, says Erica Salmon Byrne at Ethisphere.

Mckinsey and Company

APRIL 26, 2023

Organizations today face ten significant shifts. Here’s what to do about them.

Law 360 M&A

APRIL 26, 2023

Voyager Digital told a New York bankruptcy judge Wednesday it will be pivoting to liquidation of its $1 billion in cryptocurrency assets in the wake of the collapse of its purchase agreement with Binance.US.

Mckinsey and Company

APRIL 26, 2023

Richard Eklund, chief technology officer of Tibber, discusses how the fast-growing energy company cultivates purpose, autonomy, and mastery.

Law 360 M&A

APRIL 26, 2023

A group of insolvent insurers told the North Carolina Court of Appeals on Tuesday that a trial court improperly denied them fraud damages despite finding that embattled mogul Greg Lindberg and his related companies broke their promise to help safeguard policyholder funds.

Reynolds Holding

APRIL 26, 2023

Regulation A (Reg A) offerings were revamped under the Jumpstart Our Business Startups Act (JOBS Act) in 2012 to increase the maximum offering size of exempt securities from $5 million to $50 million. [1] However, despite this potential source of early-stage financing for small businesses, only 240 Reg A filings were received by the Securities and Exchange Commission (SEC) in 2021, and only 229 were received in2022, with an average total amount of funding of about $5 billion per year, representi

Law 360 M&A

APRIL 26, 2023

Microsoft Corp. says it will appeal a decision by Britain's antitrust authority to shoot down its $69 billion takeover of Activision Blizzard Inc., leaving competition lawyers calculating legal tactics and possible outcomes as both sides prepare to spar over the decision.

NYT M&A

APRIL 26, 2023

Carrier Global Corp., plans to acquire a unit of Viessmann Group that produces heat pumps, seen in Berlin as the heating solution for Germany’s green future.

The Guardian M&A

APRIL 26, 2023

CMA surprised sector by saying deal would give Seattle firm undue power to shape cloud gaming Microsoft’s attempted acquisition of Activision Blizzard, the development conglomerate behind games including Call of Duty, World of Warcraft and Candy Crush Saga, has been blocked by the UK’s competition watchdog in a surprise move. The $70bn (£65bn) purchase would have been the largest in gaming history but now, unless the two companies can convince a tribunal to overturn the ban on appeal, it is dead

Mckinsey and Company

APRIL 26, 2023

Decathlon CEO Barbara Martin Coppola on how the global retailer cultivates its entrepreneurial spirit and stays true to its values in the face of disruption.

Financial Times M&A

APRIL 26, 2023

Last-minute cancellation suggests Canadian miner lacked confidence to win resolution to split company

Class VI Partner

APRIL 26, 2023

What We’re Hearing: Market is Slowing but Long-term Outlook Remains Favorable One of the industries that saw the most growth through the pandemic was undoubtedly the pet sector.

Business Wire M&A

APRIL 26, 2023

ロンドン&ニューヨーク--(BUSINESS WIRE)--ビジネスワイヤ) -- ブランド保護ソリューションおよび知的財産権(IP)管理分野のグローバルリーダーであるオプセックグループと特殊目的買収企業であるインベストコープ・ヨーロッパ・アクイジション・コープI(Nasdaq:IVCB)(インベストコープ・ヨーロッパ)は本日、オプセックグループが公企業になることを決定する企業結合契約を締結したことを発表しました。提案された企業結合が完了すると、新たに結合された会社はオプセックグループとして運営されます。 会社概要 オプセックグループは、ブランドと知的財産の管理・保護におけるグローバルリーダーです。企業がアイデンティティ、アイデア、資産の価値を最適化し、収益化し、保護することを、テクノロジーを駆使したさまざまなサービス、製品、ソリューションを通じて支援しています。

Merrimack Business Appraisers

APRIL 26, 2023

A common question I am asked is: Can this business be valued? In the first blog in this series, the focus was on determining the value of a business that has been operating for years, but with incomplete or poor financial data. The focus of this blog is on valuation of a start-up business. How […] The post Can this business be valued? Second in a series. appeared first on Merrimack Business Appraisers.

Business Wire M&A

APRIL 26, 2023

LONDRES e NOVA YORK--(BUSINESS WIRE)--OpSec Group, líder mundial em soluções de proteção de marca e gestão de propriedade intelectual (IP), e Investcorp Europe Acquisition Corp I (Nasdaq: IVCB) ("Investcorp Europe"), uma empresa de aquisição com finalidade especial, anunciaram hoje que assinaram um contrato definitivo de combinação de negócios que resultaria no OpSec Group se tornar uma empresa pública.

Appraiser Newsroom

APRIL 26, 2023

Sherrie Galderisi, Marty Ortiz and Anita Luciani at the Registration Desk The ASA-IFA Eastern Region Appraisal Conference was recently held at the Tropicana Hotel & Casino in Atlantic City, NJ with nearly 100 people in attendance over the course of two days. The conference offered students either the option of “In Person” or “Virtual/Zoom” The speaker’s presentations were structured around the latest up to date methods, issues or concerns facing Real Estate Appr

Business Wire M&A

APRIL 26, 2023

NEW YORK--(BUSINESS WIRE)--Standard General L.P. (“Standard General”) today notes the following statement from Asian Americans Advancing Justice - AAJC, National Action Network, National Urban League, and UnidosUS, highlighting the unfair treatment from the FCC of Standard General’s pending acquisition of TEGNA.

Benzinga

APRIL 26, 2023

Carrier Global Corp (NYSE: CARR ) announces the acquisition of Viessmann Climate Solutions, a segment of Viessmann Group, in a cash and stock transaction valued at €12 billion. Viessmann Family will receive 20% of the purchase price in Carrier stock with a long-term commitment to hold shares. Privately held Viessmann Climate Solutions is headquartered in Allendorf, Germany , with a presence in Germany, Italy, France, and Poland.

Benchmark Report

APRIL 26, 2023

Benchmark is pleased to announce the transaction between Premiere Lawn Service, Incorporated, and Monarch Landscape Companies, a portfolio company of Audax Private Equity. The transaction creates a strategic expansion into the Washington state market.

Benzinga

APRIL 26, 2023

Getty Images Holdings Inc (NYSE: GETY ) shares are volatile Wednesday after the company responded to Trillium Capital's takeover proposal. What To Know: Earlier this week, Trillium announced a non-binding proposal to acquire Getty Images for $10 per share in cash, but named a number of contingencies. Contingencies included immediate engagement by the board, due diligence, satisfactory financing arrangements as well as a satisfactory purchase and sale contract, completion of all regulatory ma

Let's personalize your content