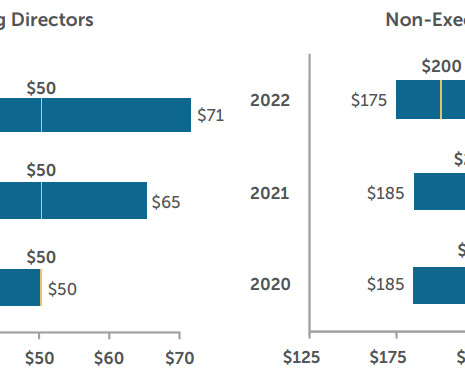

Director Compensation: Increases Are Back Among the Largest US Companies

Harvard Corporate Governance

AUGUST 21, 2023

Posted by Dan Laddin, Matt Vnuk and Kyle White, Compensation Advisory Partners, on Monday, August 21, 2023 Editor's Note: Dan Laddin and Matt Vnuk are Partners, and Kyle White is an Associate at Compensation Advisory Partners. This post is based on a CAP memorandum by Mr. Laddin Mr. Vnuk, Mr. White, and Patricia Kelley. Related research from the Program on Corporate Governance includes The Growth of Executive Pay by Lucian Bebchuk and Yaniv Grinstein.

Let's personalize your content