Lighthouse lessons: Four mindsets to make digital transformation stick

Mckinsey and Company

APRIL 23, 2025

Adapting to rapidly evolving technology means investing in people who drive change on the ground.

Mckinsey and Company

APRIL 23, 2025

Adapting to rapidly evolving technology means investing in people who drive change on the ground.

NYT M&A

APRIL 23, 2025

The Dispatch, a right-of-center political news and commentary start-up, plans to keep the legal news website available at no cost. Terms of the deal were not disclosed.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Mckinsey and Company

APRIL 23, 2025

As companies increasingly rely on data to innovate and grow, ineffective (or nonexistent) data product practices have become a top strategic issue.

Auto Dealer Valuation Insights

APRIL 23, 2025

Thomas C. Insalaco, CFA, ASA is presenting a webinar sponsored by Trustate for their subscribers on April 30, 2025, at 12:00 PM CDT. His webinar is titled “Navigating Business Valuations: Batten Down the Hatches.” This is the second in a two-part series on navigating business valuations.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Mckinsey and Company

APRIL 23, 2025

In a shifting world order, US companies continued success will hinge on an understanding of policymakers intentions.

Law 360 M&A

APRIL 23, 2025

SCOTUSblog has been sold to digital media company The Dispatch, according to announcements from both publications Wednesday, marking a new chapter for the U.S. Supreme Court-focused legal publication while its co-founder Tom Goldstein faces criminal charges.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Law 360 M&A

APRIL 23, 2025

Investor-side firm Bernstein Litowitz Berger & Grossmann LLP has disclosed in a court filing that it is seeking to hire Jorge Tenreiro, the former head of the U.S. Securities and Exchange Commission's crypto enforcement unitas well as the onetime chief of the agency's entire litigation team.

Financial Times M&A

APRIL 23, 2025

Repercussions of the Italian governments actions are likely to be relatively contained

Machen McChesney

APRIL 23, 2025

Suppose youre thinking about setting up a retirement plan for yourself and your employees. However, youre concerned about the financial commitment and administrative burdens involved. There are a couple of options to consider. Lets take a look at a Simplified Employee Pension (SEP) and a Savings Incentive Match Plan for Employees (SIMPLE).

Norman Marks

APRIL 23, 2025

Claire Berry has shared an excellent set of Ten Things Internal Audit Teams Should Do In Turbulent Times: Refresh the Risk Assessment Be Agile with the Audit Plan Monitor for Control Breakdowns Audit Crisis Response and Continuity Watch Third-Party Risk Support Cost Containment Keep Ethics in Focus Communicate with Courage Track Regulatory Shifts Support Your […]

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Financial Times M&A

APRIL 23, 2025

UK telecoms group enters preliminary agreement to sell stake in BT Italia to Retelit

Law 360 M&A

APRIL 23, 2025

Attorneys at Monteverde & Associates PC urged an Illinois federal judge not to order certain sanctions against them in a challenge to so-called mootness fees paid to settle and dismiss allegedly baseless merger disclosure suits, saying more sanctions would be inconsistent with "well-established" pleading and sanctions standards.

John Jenkins

APRIL 23, 2025

In our latestDeal Lawyers Download Podcast, H/Advisors Abernathy’s Dan Scorpio joined me to discuss the evergreen topic of deal leaks.

Law 360 M&A

APRIL 23, 2025

Shares of special purpose acquisition company Texas Ventures Acquisition III began trading on Wednesday after the company raised $200 million in its initial public offering, with plans to seek out a merger with an industrial technology company.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Financial Times M&A

APRIL 23, 2025

Plus, Jane Streets $20bn year and pension funds partner with private equity

Law 360 M&A

APRIL 23, 2025

The Federal Communications Commission has sought data from more than half a dozen telecom and cable companies as it probes T-Mobile's planned $4.4 billion merger with UScellular's wireless operations.

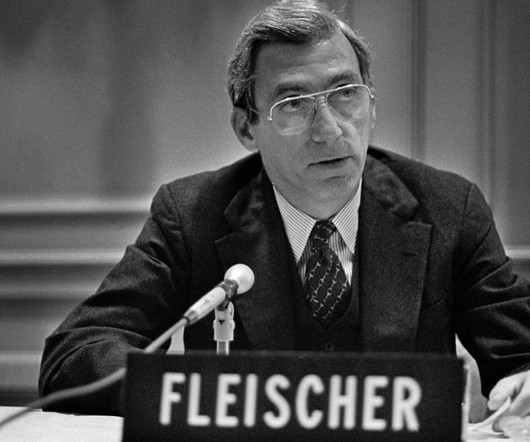

NYT M&A

APRIL 23, 2025

He was a top deal maker in the world of mergers and acquisitions, during the 1980s takeover boom and beyond. He also had a keen interest in art.

Law 360 M&A

APRIL 23, 2025

Skadden has bolstered its New York-based team of finance attorneys with the addition of a longtime Covington partner into the firm's financial institutions group who brings with him more than two decades of experience including in-house and BigLaw work.

Harvard Corporate Governance

APRIL 23, 2025

Posted by Andrew Noreuil, Brian Massengill and Andrew Stanger, Mayer Brown LLP, on Wednesday, April 23, 2025 Editor's Note: Andrew Noreuil and Brian J. Massengill are Partners, and Andrew J. Stanger is a Knowledge Counsel, at Mayer Brown LLP. This post is based on their Mayer Brown memorandum,and is part of the Delaware law series ;links to other posts in the series are available here.

Law 360 M&A

APRIL 23, 2025

Kirkland & Ellis LLP announced Wednesday that it has boosted its corporate practice in Houston by bringing on a partner with deep private equity experience in the energy sector who came aboard after a decade at Vinson & Elkins LLP.

Harvard Corporate Governance

APRIL 23, 2025

Posted by Joo Pedro Nascimento, Brazilian Securities and Exchange Commission (CVM), on Wednesday, April 23, 2025 Editor's Note: Joo Pedro Nascimento is the Chairman at the Brazilian Securities and Exchange Commission (CVM). All around the world, regulators are redesigning capital market frameworks to attract small and medium enterprises (SMEs), recognizing that public markets offer unique advantages for growth-stage companies, including superior price discovery, enhanced liquidity, greater finan

Law 360 M&A

APRIL 23, 2025

Private equity giant Apollo, advised by Orrick Herrington & Sutcliffe LLP, on Wednesday announced plans to commit up to $220 million into a new joint venture partnership with Brown Rudnick LLP-led Bullrock Energy Ventures.

Equidam

APRIL 23, 2025

What is dilution? TLDR: Dilution is the reduction in the ownership percentage in a certain company as an effect of the issuance of shares. Dilution refers to the reduction of an individual shareholder’s ownership percentage in a company as a result of the issuance of new shares. In the context of startup investing, dilution can occur when a company raises capital through the sale of additional shares to investors.

Law 360 M&A

APRIL 23, 2025

Bitcoin investment startup Twenty One Capital Inc. plans to go public by merging with a special purpose acquisition company affiliated with Cantor Fitzgerald at a $3.6 billion valuation, in a deal guided by three law firms, the parties announced on Wednesday.

Benzinga

APRIL 23, 2025

On Tuesday, Nomura Holdings Inc (NYSE: NMR ) disclosed a definitive agreement to acquire Macquarie Group, Ltd.’s (OTC: MCQEF ) public asset management operations in the U.S. and Europe in an all-cash deal valued at $1.8 billion. The deal includes around $180 billion in assets under management from retail and institutional clients, spanning equity, fixed income, and multi-asset strategies.

Law 360 M&A

APRIL 23, 2025

Toronto-based mining company Sierra Metals Inc. said Wednesday it has reached a preliminary agreement to sell the business to Alpayana Canada in a deal worth approximately $176 million, in a U-turn for the company after characterizing an earlier Alpayana offer as a "hostile" takeover bid.

ThomsonReuters

APRIL 23, 2025

Highlights: Simplifying corporate compliance : Managing deadlines and due dates across jurisdictions and tax types Mitigating risk with automation : Reducing the risk of missed deadlines and last-minute fire drills with automated updates and increased visibility Streamlining tax department workflows : Improving efficiency, accuracy, and collaboration with a centralized and customizable calendar solution Enhancing remote work capabilities : Enabling anywhere, anytime access to tax guidelines and

Law 360 M&A

APRIL 23, 2025

Retelit SpA said Wednesday that it has agreed to acquire British Telecom's remaining stake in BT Italia SpA to boost its capacity and meet growing demand.

Class VI Partner

APRIL 23, 2025

After a few flat years for M&A in consumer packaged goods (CPG), some analysts are predicting an upturn for the industry starting in 2025. But what kinds of companies are most likely to attract investor interest? Below, we detail some of the characteristics most likely to help CPG firms succeed in the M&A market.

Law 360 M&A

APRIL 23, 2025

Texas' proposal to become the latest state to license paraprofessional providers of limited legal services could help firms expand their reach and improve access to justice, but consumers, attorneys and allied legal professionals would benefit even more if similar programs across the country become more uniform, says Michael Houlberg at the University of Denver.

Peak Business Valuation

APRIL 23, 2025

Looking for an accurate estimate of your insurance agencys value? Valuation multiples play an important role in valuing an insurance agency. However, determining reliable insurance agency valuation multiples requires an extensive assessment. To ensure accuracy, it is best to work with a professional business appraiser. During a professional insurance agency valuation, an appraiser considers a wide variety of factors that influence the value of an insurance agency.

Law 360 M&A

APRIL 23, 2025

With deals stalling in a market defined by uncertainty, attorneys and the dealmakers they counsel are leaning on creative structures from earnouts to partial stake sales to keep transactions alive, according to corporate lawyers advising on major mergers and acquisitions.

Benzinga

APRIL 23, 2025

VANCOUVER, British Columbia, April 23, 2025 (GLOBE NEWSWIRE) -- Precore Gold Corp. (CSE: PRCG ) (the "Company" or "Precore Gold") is pleased to announce that it has entered into a Definitive Option Agreement (the "Option Agreement") with Alta Copper Corp. (the "Vendor") to acquire up to a 100% interest in the Arikepay gold-copper property (the "Arikepay Property") located in the province of Arequipa, Peru (the "Transaction").

Law 360 M&A

APRIL 23, 2025

Lockheed Martin said Wednesday it has agreed to acquire the Rapid Solutions business of Paul Hastings LLP-advised Amentum for $360 million in cash, bolstering Lockheed's capabilities in space-based intelligence, surveillance and reconnaissance tactical systems.

Let's personalize your content