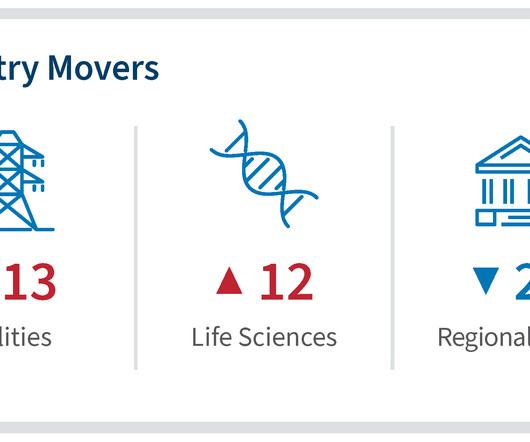

Regulatory Intensity and Firm-Specific Exposure

Harvard Corporate Governance

SEPTEMBER 27, 2023

Posted by Joseph Kalmenovitz (University of Rochester), on Wednesday, September 27, 2023 Editor's Note: Joseph Kalmenovitz is an Assistant Professor of Finance at the Simon Business School, University of Rochester. This post is based on his recent paper forthcoming in the Review of Financial Studies. Summary Regulation is a fundamental economic concept.

Let's personalize your content