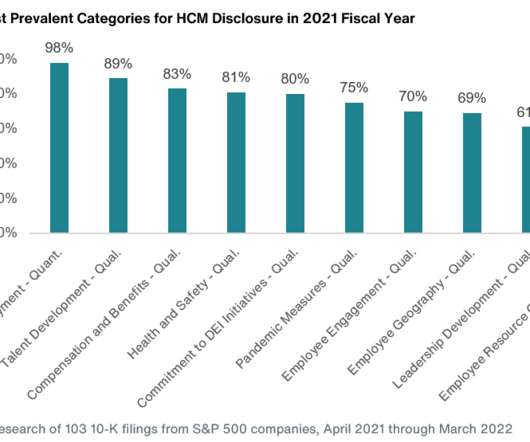

Key Themes of Human Capital Management Disclosure

Harvard Corporate Governance

MAY 16, 2022

Posted by Pam Greene, David Kritz, and Anna Barrera, Aon plc, on Monday, May 16, 2022 Editor's Note: Pam Greene is Partner, David Kritz is Associate Partner, and Anna Barrera is Senior ESG Consultant at Aon plc. This post is based on an Aon memorandum by Ms. Greene, Mr. Kritz, Ms. Barrera, and Grant Hinrichsen. Related research from the Program on Corporate Governance includes Stakeholder Capitalism in the Time of COVID , by Lucian Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the

Let's personalize your content