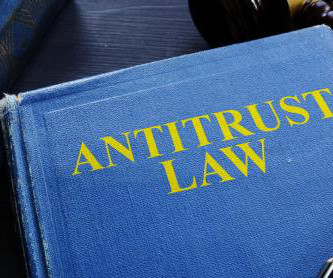

Does ESG Crowd Out Support For Government Regulation?

Harvard Corporate Governance

SEPTEMBER 12, 2023

Posted by Hajin Kim (University of Chicago), Joshua Macey (University of Chicago), and Kristen Ann Underhill (Cornell University), on Tuesday, September 12, 2023 Editor's Note: Hajin Kim and Joshua C. Macey are Assistant Professors of Law at the University of Chicago Law School, and Kristen Ann Underhill is Professor of Law at Cornell Law School. This post is based on their recent paper.

Let's personalize your content