Telling the Story Behind Funding | Meaden & Moore

Meade & Moore

MAY 6, 2025

Why are expense ratios so important? According to a survey by Fidelity Charitable, 75% of respondents would donate more money to charity.

Meade & Moore

MAY 6, 2025

Why are expense ratios so important? According to a survey by Fidelity Charitable, 75% of respondents would donate more money to charity.

Global Finance

MAY 6, 2025

The Caribbean economies have been broadly hit by slowing remittances and a cooling internal labor market. GDP for the Caribbean countries and territories from which our winners are selected is estimated by the International Monetary Fund (IMF) to have grown an average of 2.5% in 2024. On the banking side, consumer-focused trends such as expanding loan portfolios and digital inclusion were the stars of the show.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Mckinsey and Company

MAY 6, 2025

US healthcare organizations could save up to $700 million annuallyand improve careby reducing frontline-nurse turnover through strengthened manager support.

Global Finance

MAY 6, 2025

The maximal net interest margin (NIM) dynamic enjoyed by banks in the Asia-Pacific (APAC) region in 2023 tailed off in some countries last year, most notably in Australia where NIM fell a combined 7 basis points (bps) for the big four banks and continued its seemingly relentless contraction in China, breaking below 1.8% for the big six lenders as supply side boosts failed to meet commensurate demand and profits were squeezed.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Mckinsey and Company

MAY 6, 2025

Three experts discuss the challenges corporate boards face in managing growing geopolitical risk, and how to tackle them.

Global Finance

MAY 6, 2025

Building on a profitable and dynamic 2023, when high interest rates buoyed bank lending margins, most Western European banks had a strong 2024, ending the year with a spurt in net income and revenue growth. Many increased their focus on sustainable finance (with green bonds as a major growth area), diversified their revenue streams, and invested in new banking technologymodernizing existing apps and exploring new possibilities.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Global Finance

MAY 6, 2025

African Banks ave operated in key markets outside the continent mainly through representative offices. Today, a shift is taking place. The number of homegrown African banks becoming ambitious and opening operations in Western capitals is rising. Zenith Bank , Vista Bank, and Banque Exterieure dAlgerie (BEA) have announced plans to venture into France.

Harvard Corporate Governance

MAY 6, 2025

Posted by Charles Crain, National Association of Manufacturers, on Tuesday, May 6, 2025 Editor's Note: Charles Crain is the Managing Vice President of Policy at the National Association of Manufacturers. This post is based on his testimony in a hearing of the Subcommittee on Capital Markets of the House Committee on Financial Services. Good afternoon Chair Wagner, Ranking Member Sherman, and members of the Subcommittee on Capital Markets.

Global Finance

MAY 6, 2025

The banking industry in Central and Eastern Europe (CEE) faced a particularly challenging 2024, marked by a highly fluid interest rate environment, macroeconomic uncertainty, and political volatility. Further complicating the situation was the continuing geopolitical shadow of the Russia-Ukraine conflict, which entered its third year in February of 2024.

NYT M&A

MAY 6, 2025

The distributors owners, Amy Heller and Dennis Doros, made the unusual choice to give it away. Their successor is Maya Cade of the Black Film Archive.

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Global Finance

MAY 6, 2025

The country winners for Best Banks in the Middle East region continue to aggressively implement a broad range of initiatives to elevate and modernize their respective franchises. This involves significant service upgrades with new digital features and tailored financial management tools to boost client engagement. Many banks have achieved first-to-market success with newly launched products and services.

Mckinsey and Company

MAY 6, 2025

Recently announced ODA reductions create a clear call to action, including in initiative prioritization, productivity improvements, and reassessing the design of the current system.

Financial Times M&A

MAY 6, 2025

Takeover comes after UK companys struggles since going public four years ago

Mckinsey and Company

MAY 6, 2025

Theres no one-size-fits-all approach to managing risk and resilience. Chief risk officers can benefit from examining their innate operating modelsand understanding when they need to change.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Machen McChesney

MAY 6, 2025

Determining reasonable compensation is a critical issue for owners of C corporations and S corporations. If the IRS believes an owners compensation is unreasonably high or low, it may disallow certain deductions or reclassify payments, potentially leading to penalties, back taxes and interest. But by proactively following certain steps, owners can help ensure their compensation is seen as reasonable and deductible.

Financial Times M&A

MAY 6, 2025

Several transactions are on the table with billionaire investors, overseas shareholders and domestic politicians all affected

Appraisers Blog

MAY 6, 2025

In reply to JR. Nope. Wrong again. Many of the mb’s and appraisers whom were partaking in the inflated highest and best over valuation game were washed out fired or both. Entire institutions and people whom worked for them were gone before amc’s ever gained dominance. Stop whining about appraisers whom stand up for their careers, casting a blanket and projecting your own insecurities regarding a valid secondary check and balance system.

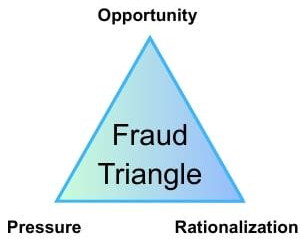

LaPorte

MAY 6, 2025

No business is immune to fraud. Even if youve built a robust control environment, your business could be vulnerable to threats. This is especially true… The post The Psychology of Fraud first appeared on LaPorte.

Appraisers Blog

MAY 6, 2025

In reply to JR. Pointing the finger at appraisers for the 2008 crash is like blaming the weatherman for the storm. Were some appraisers swayed by lender pressure? Sure. But the real architects of the disaster were Wall Streets toxic mortgage-backed securities, regulators napping on the job, and lenders peddling predatory loans. Appraisers didnt dream up subprime mortgages or package them into trillion-dollar catastropheswe were just trying to navigate a rigged market.

Mckinsey and Company

MAY 6, 2025

National productivity growth is a matter of few firms taking bold strategic action rather than millions of firms raising efficiency.

Appraisers Blog

MAY 6, 2025

In reply to Baggins. How essential were the appraisers in the 2008 crash, the largest in our history? I’ll give you a hint while you are touting our irreplaceable importance to consumer protection, we were right at the foundation of the housing crisis. Negative Ams, buydowns, Builder points in excess of 15% skyrocketing appreciation. Yep, they appraised just fine.

Financial Times M&A

MAY 6, 2025

The sneaker makers low debt and high ratio of sales outside the US made it an attractive takeover target

Appraisers Blog

MAY 6, 2025

Im not sure that this new form is all that and a bag of chips. Will it even survive to become THE FORM? If it does get put into place I predict it will not last for 12 months.

Financial Times M&A

MAY 6, 2025

Billionaire financiers bid to emulate the Oracle of Omaha comes with some quirks

Appraisers Blog

MAY 6, 2025

In reply to Joseph. It is precisely why GSE’s keep scope creep and adding more and more data points, data analysis, new forms, 1004MC is in… then 1004MC is out… and all sorts of requirements. They truly believe that they have pushed appraisers out with “modernization” while appraisers continue to adapt… and very well at that.

Global Finance

MAY 6, 2025

Elected to lead the Catholic Church in 2013 after the sudden abdication of his predecessor Benedict XVI, Argentinian Cardinal Jorge Maria Bergoglio chose his pontifical name to echo the saint of the poor, Francis of Assisi. Considered controversial by many conservative Catholics for his nontraditional stands on issues like homosexuality, immigration, and the role of women in the church, he quickly became known as the Peoples Pope, advocating for the poor, the marginalized, and the most vulnerabl

Appraisers Blog

MAY 6, 2025

In reply to Baggins. ” Only deficient appraisers whom cant make a living, turn to exploitative amc models. Meaning the other three out of four appraisers whom service legal, courts, government, private, and the best lenders in the business whom did not take the amc route, theyre the deficient appraisers. Its the cut rate outsourcing automated amc appraisers whom are the best.

Appraisers Blog

MAY 6, 2025

In reply to Mike Ford, AGA. Thanks. When I write appeals for help in this industry, I find it rather common to include links to some of your previous articles, as well as Mr Bagotts. I can pick them somewhat randomly and they are still entirely relevant.

Financial Times M&A

MAY 6, 2025

Plus, DoorDash buys Deliveroo and private equity gets in on defence

Appraisers Blog

MAY 6, 2025

The PAREA program markets itself as a fast, mentor-free route to becoming an appraiser, but its high cost & empty promises often disappoint.

Mckinsey and Company

MAY 6, 2025

Five core practices can help federal leaders handle management challenges and achieve tangible impact in their roles.

Appraisers Blog

MAY 6, 2025

In 1983-1984 I followed my mentor around like a puppy. There is simply no substitute for in-the-field, one-on-one training from someone who knows what they are doing. I heard “no, do it again” so many times I lost count. 42 years later, the lessons Ross Boumann SRA taught me are still relevant. Thank you sir.

NYT M&A

MAY 6, 2025

The acquisition would give DoorDash a presence in the Middle East and expand its footprint in Europe.

Let's personalize your content