Chancery Invalidates Elon Musk’s $55.8 Billion Equity Compensation Package

Harvard Corporate Governance

FEBRUARY 21, 2024

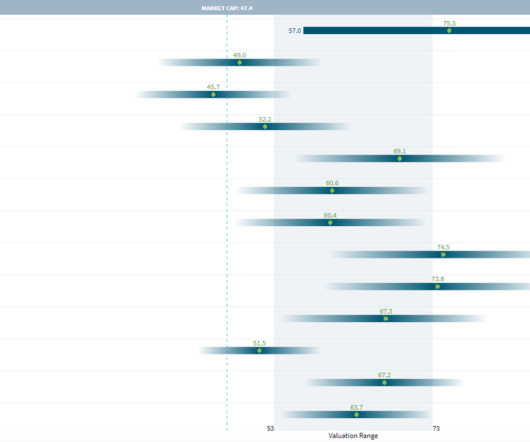

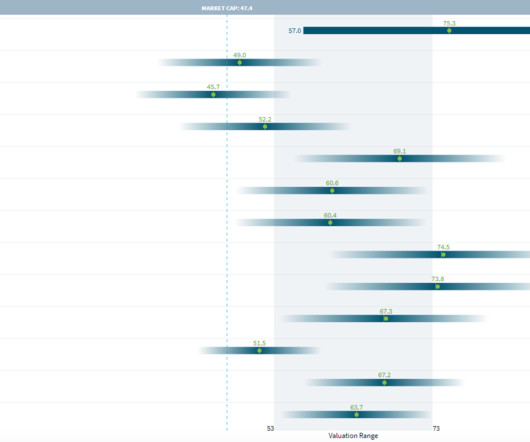

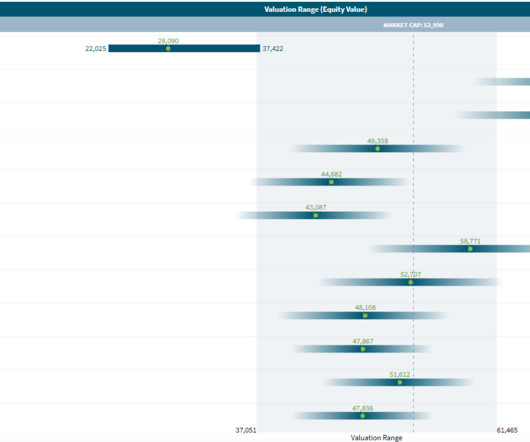

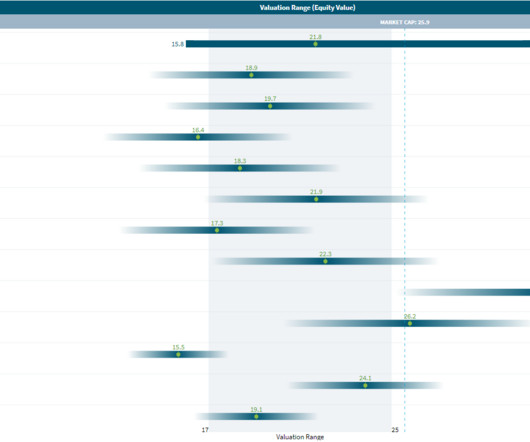

3] The Grant On January 21, 2018, Tesla’s Board of Directors (the “Board”) [4] unanimously approved the Grant, which would vest based on Tesla’s achievement of certain market capitalization goals, as well as operational milestones related to revenue and adjusted EBITDA targets. The process arrived at an unfair price.” [3]

Let's personalize your content