Atlantica Announces the Acquisition of Two Wind Assets in the United Kingdom

Benzinga

MARCH 25, 2024

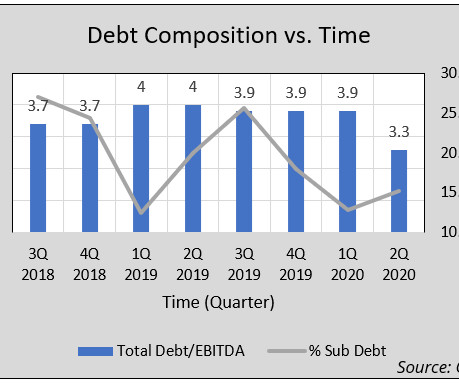

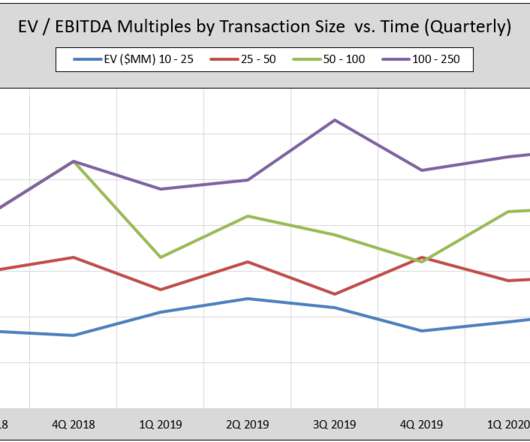

The purchase price represents an Enterprise Value 1 /EBITDA 2 multiple of approximately 6.6 Non-GAAP Financial Measures This press release also includes certain non-GAAP financial measures, including EBITDA and Enterprise Value to EBITDA. These are Atlantica's first operating assets in the U.K.,

Let's personalize your content