Can Salesforce return to its former lofty heights, after slumping 50% from its all time high?

Valutico

DECEMBER 6, 2022

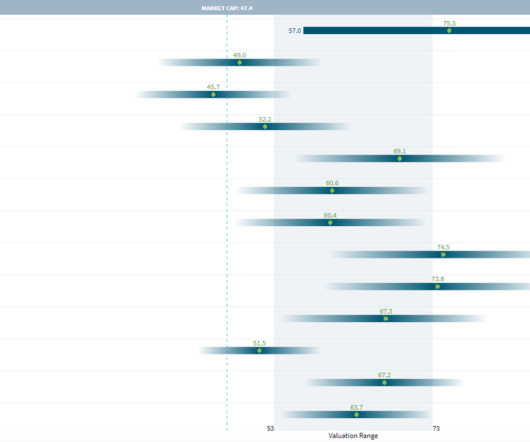

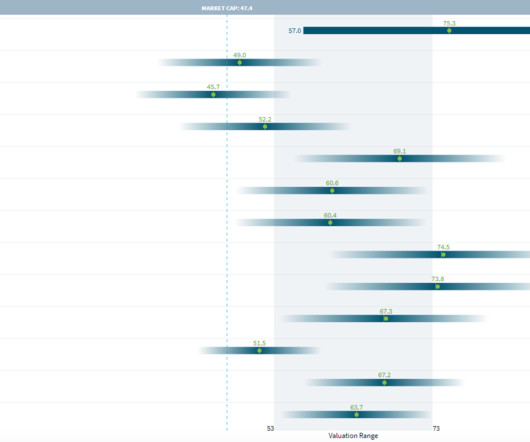

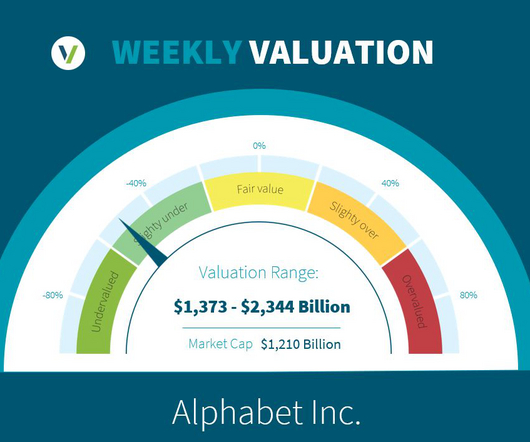

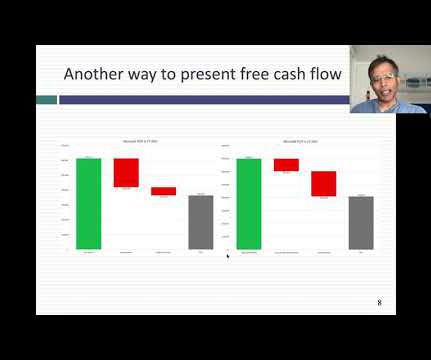

At the current level Salesforce has a P/E ratio of 100x and an EV/EBITDA ratio of 47x for 2022. This was mainly driven by operating expenses growth exceeding sales growth and thus putting strain on EBITDA margin. Salesforce’s five-year share price chart is shown below: Source: Yahoo Finance, [link]. Valutico Analysis.

Let's personalize your content