Data Update 4 for 2023: Country Risk - Measures and Implications

Musings on Markets

FEBRUARY 11, 2023

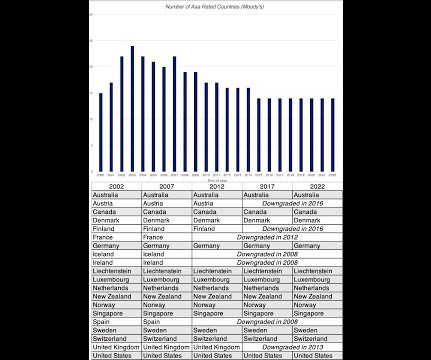

In this section, I will begin measures of country default risk, including sovereign ratings and CDS spreads, before moving to more expansive measures of country risk before concluding with measures of equity risk premiums for countries, a pre-requisite for estimating the values of companies with operations in those countries.

Let's personalize your content