Data Update 1 for 2024: The data speaks, but what does it say?

Musings on Markets

JANUARY 5, 2024

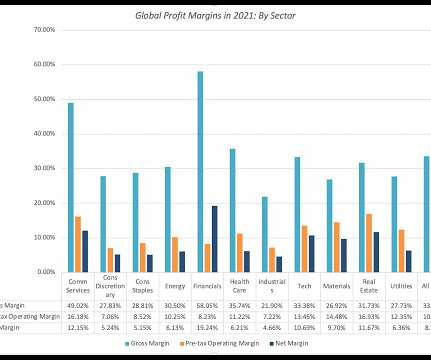

I have also developed a practice in the last decade of spending much of January exploring what the data tells us, and does not tell us, about the investing, financing and dividend choices that companies made during the most recent year. Dividends and Potential Dividends (FCFE) 1. Return on (invested) capital 2.

Let's personalize your content