A Follow up on Inflation: The Disparate Effects on Company Values!

Musings on Markets

MAY 20, 2022

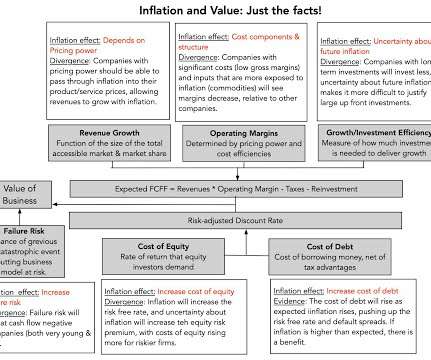

In my last post , I discussed how inflation's return has changed the calculus for investors, looking at how inflation affects returns on different asset classes, and tracing out the consequences for equity values, in the aggregate.

Let's personalize your content