META Lesson 3: Tell me a story!

Musings on Markets

NOVEMBER 15, 2022

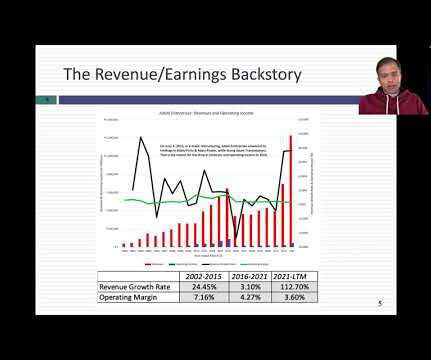

In this post, I want to focus on that point, starting with a discussion of why stories matter to investors and traders and the story that propelled the company to a trillion-dollar market capitalization not that long ago. billion in revenues in 2021.

Let's personalize your content