How to Calculate Discounted Cash Flows for Quarterly or Monthly Periods?

Equilest

JUNE 16, 2023

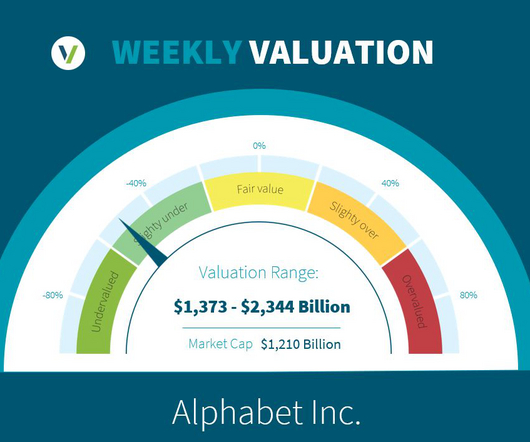

How to Calculate Discounted Cash Flows for Quarterly or Monthly Periods - A Comprehensive Guide Introduction In financial analysis, calculating discounted cash flows (DCF) is a fundamental method used to evaluate the value of an investment or project.

Let's personalize your content