EV/EBITDA Explained: A Key Valuation Multiple for Investors

Valutico

MAY 19, 2025

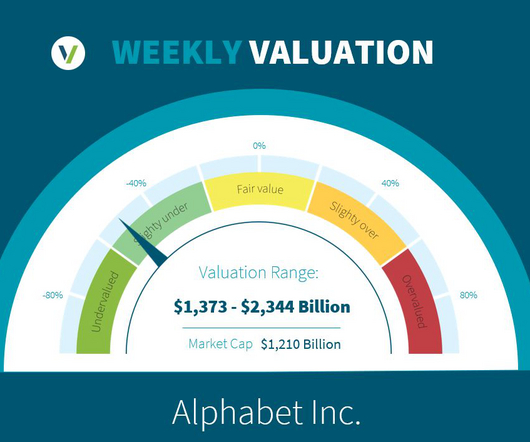

Company valuation employs different methodologies, including intrinsic approaches like Discounted Cash Flow (DCF) analysis, and relative valuation. The core idea behind relative valuation is to estimate a company’s value by comparing it to similar companies based on how the market prices their financial metrics.

Let's personalize your content