Data Update 1 for 2022: It is Moneyball Time!

Musings on Markets

JANUARY 8, 2022

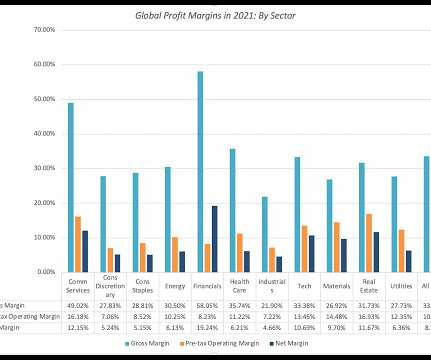

Regional Breakdown My data sample for 2022 includes every publicly traded firm that is traded anywhere in the world, with a market capitalization that exceeds zero. A few of these variables are macro variables, but only those that I find useful in corporate finance and valuation, and not easily accessible in public data bases.

Let's personalize your content