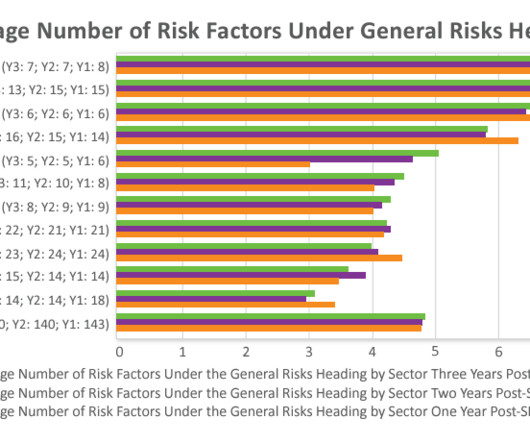

SEC Risk Factors Disclosure Analysis

Harvard Corporate Governance

DECEMBER 3, 2023

Public companies continue to be challenged to create and protect enterprise value and stakeholder trust in the face of these and other significant risks.

Harvard Corporate Governance

DECEMBER 3, 2023

Public companies continue to be challenged to create and protect enterprise value and stakeholder trust in the face of these and other significant risks.

RNC

APRIL 22, 2025

As ESG disclosures become more mainstream, there’s growing interest in how ESG metrics in India influence enterprise value, especially among institutional investors. For companies evaluating tools, an ESG software comparison or guide to compare ESG rating agencies can help align solutions with reporting goals and compliance needs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Equidam

JUNE 10, 2025

French startups frequently have preferred shares with liquidation preferences, meaning not all shares are equal in value. In such cases, a technique like the Option Pricing Model (OPM) is used to allocate the enterprise value between share classes. And if you ever have an external audit or due diligence (e.g.,

Audit Board

MARCH 15, 2023

In our time on the Product team at AuditBoard, we’ve worked with customers who have very diverse audit, risk, and compliance programs, but they all have something in common: every single one has an ecosystem of applications that work together in some form for the organization to manage risk. What Is an Integration?

Cooley M&A

MAY 23, 2024

Pricing Policy limits The coverage limit under R&W insurance policies is usually around 10% of the enterprise value of the transaction, with a floor of about $5 million of coverage, making R&W insurance a less attractive option for smaller or lower mid-market deals with enterprise values below $20 million.

Audit Board

SEPTEMBER 28, 2022

Collectively, we can drive value creation once we move beyond the silos that often entrap the audit, risk, and compliance functions. Collaboration is the platform we can use to generate ever greater enterprise value in the years ahead. We must regard collaboration as a genuine business imperative.

Sun Acquisitions

JANUARY 24, 2022

Pitfall #4 Failing to check compliance issues. Takeaway : “ You don’t want to miss out on the work in process or working capital needs because it can have a real swing in the overall enterprise value.”. When buying a business, you want to know if there are any liens on the business as soon as possible. The Bottom Line.

Let's personalize your content