Trends in Director Compensation

Harvard Corporate Governance

JANUARY 26, 2024

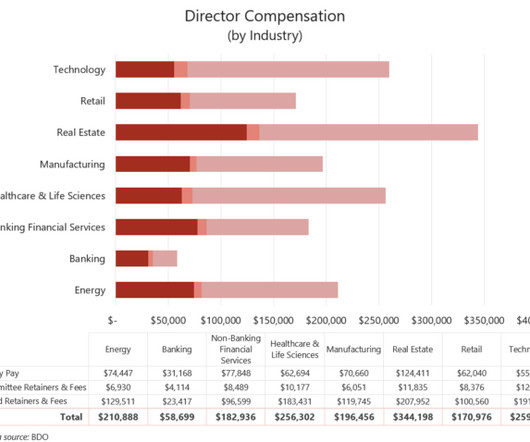

Candidate at Villanova University Charles Widger School of Law. A REVIEW OF COMPENSATION SURVEYS Historically, public company directors served without pay and with light workloads. Today, serving as a public company director entails increased demands on directors, along with related liability risks.

Let's personalize your content