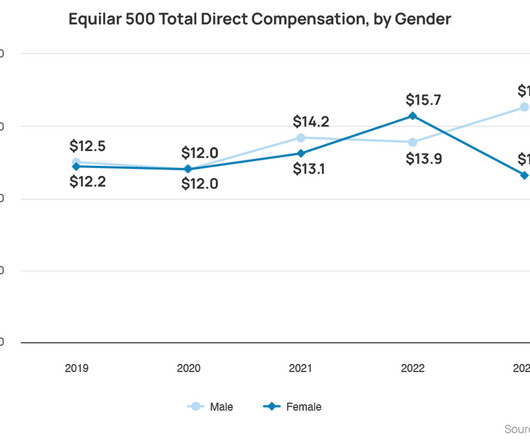

An Early Look at CEO Pay Trends From Proxy Season 2024

Harvard Corporate Governance

APRIL 18, 2024

on Thursday, April 18, 2024 Editor's Note: Joyce Chen is Associate Editor and Courtney Yu is Director of Research at Equilar, Inc. The 2024 proxy season is in full swing, as public companies are in the process of submitting their proxy statements (DEF14A) to the Securities and Exchange Commission (SEC) ahead of annual shareholder meetings.

Let's personalize your content