Strategic Growth through M&A: Scaling MSP Services with Customizable Solutions

Sun Acquisitions

MAY 3, 2024

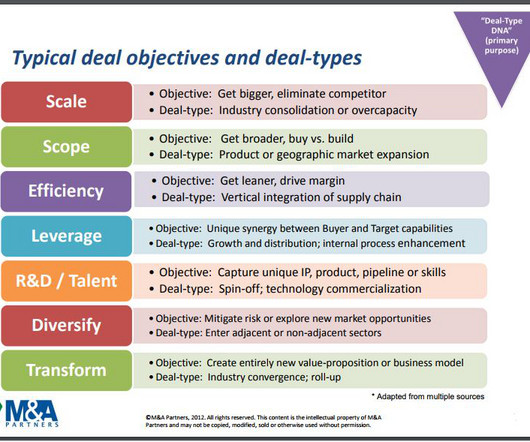

To navigate this complex environment and scale effectively, MSPs increasingly turn to mergers and acquisitions (M&A) as a strategic lever for growth. The Strategic Imperative for M&A in the MSP Sector Mergers and acquisitions present a unique opportunity for MSPs to accelerate their growth and diversify their service offerings.

Let's personalize your content