Amortization in accounting 101

ThomsonReuters

OCTOBER 5, 2023

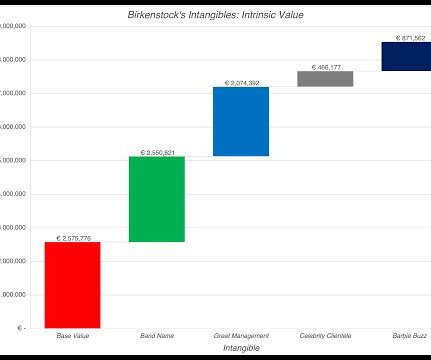

Amortization in accounting is a technique that is used to gradually write-down the cost of an intangible asset over its expected period of use or, in other words, useful life. This shifts the asset to the income statement from the balance sheet. What are intangible assets? What is an amortization schedule?

Let's personalize your content