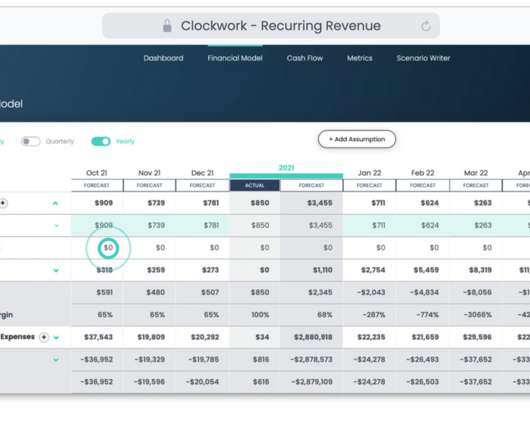

[Partner Blog] How to Forecast Recurring Revenue

Lighter Capital

OCTOBER 19, 2021

Month-over-month growth assumptions can paint a general picture of MRR for investors, but if you really want accurate projections – the type that’ll help you navigate strategic decisions and optimize your finances – you’ll ultimately need a more detailed forecast. Questions? . Reach out to their team at hello@clockwork.ai

Let's personalize your content