Data Update 4 for 2024: Danger and Opportunity - Bringing Risk into the Equation!

Musings on Markets

JANUARY 28, 2024

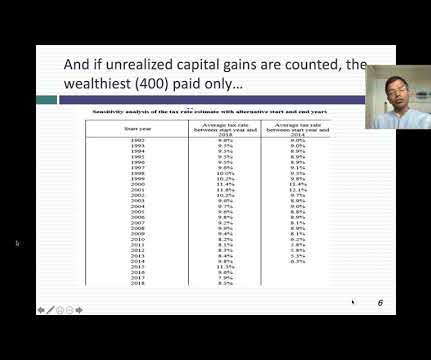

micro uncertainties, into discount rates, and in the process, they end up incorporating risk that investors can eliminate, often at no cost. He followed up by showing that holding diversified portfolios can deliver much higher returns, for given levels of risk, for all investors.

Let's personalize your content