Profits Leap at Goldman Sachs as Banks See Steady Economy

NYT M&A

OCTOBER 15, 2024

The investment bank earned more than expected in the latest quarter, a theme for other big banks, too.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

NYT M&A

OCTOBER 15, 2024

The investment bank earned more than expected in the latest quarter, a theme for other big banks, too.

Mckinsey and Company

NOVEMBER 7, 2022

Uncertain times can spell opportunity for companies seeking acquisitions—if companies proceed with care. Four actions can help banks maximize the value of their M&A.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

NYT M&A

MARCH 27, 2023

Banking regulators, which announced the deal late Sunday, had been looking for a buyer since seizing control of the failed bank.

NYT M&A

AUGUST 2, 2022

Twitter has sent out requests for information from the banks that are backing the billionaire’s purchase, which he is trying to walk away from.

NYT M&A

MAY 1, 2023

First Republic’s downfall was just the latest in a series of problems affecting midsize banks.

National Law Review M&A

MARCH 24, 2022

Sherrier Jurisdiction: All Federal Type of Law: Mergers & Acquisitions Financial Institutions & Banking Administrative & Regulatory

NYT M&A

MAY 4, 2023

Hired to help with a capital raise, Goldman Sachs advised SVB to make a move that provoked a public panic and ended with the smaller bank collapsing.

NYT M&A

MAY 1, 2023

But investors are watching to see if the deal ends the regional banking crisis. The lending giant’s shares jumped on the news that it is buying First Republic.

NYT M&A

FEBRUARY 6, 2023

the flagship company in the global banking dynasty. The family’s investment vehicle said it would offer to buy out other shareholders in Rothschild & Co.,

NYT M&A

JANUARY 13, 2023

Goldman Sachs will take a big hit from its ill-fated move into consumer banking, even as its other businesses weaken amid an economic slowdown.

NYT M&A

SEPTEMBER 17, 2024

and the Justice Department are likely to change how they evaluate mergers and acquisitions in the banking industry. The F.D.I.C.

NYT M&A

MARCH 28, 2025

Javice faked much of her customer list before selling her start-up, Frank, to the bank. Federal prosecutors convinced a jury that Ms.

NYT M&A

MARCH 30, 2023

The JPMorgan chief executive led an effort to raise $30 billion for First Republic, but no one is sure if it did any good.

NYT M&A

JULY 25, 2023

Banc of California is set to absorb PacWest, a larger lender that has seen its depositors flee this year.

NYT M&A

MAY 1, 2023

As part of its deal, 84 First Republic branches in eight states will reopen as JPMorgan branches on Monday.

NYT M&A

MAY 1, 2023

The resolution of First Republic Bank came after a frantic night of deal making by government officials and executives at the country’s biggest bank.

NYT M&A

SEPTEMBER 27, 2024

Investors are cheering a possible tie-up between UniCredit of Italy and Germany’s Commerzbank, but politics may stand in the way.

Mogin Rubin M&A

AUGUST 2, 2024

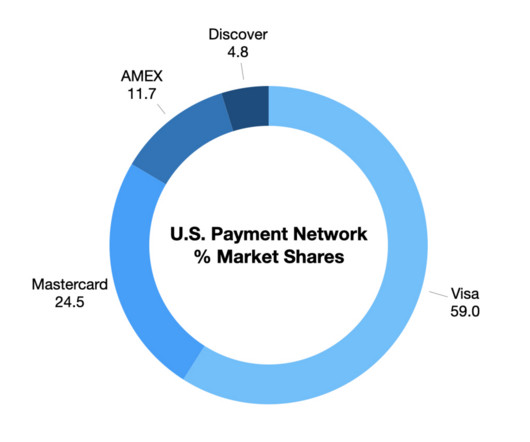

Written by Jonathan Rubin, Partner and Co-Founder of MoginRubin LLP -- When federal agencies review bank mergers, the competition issues typically relate to the number and location of physical branches and the extent of any overlap in the areas served.

NYT M&A

MARCH 19, 2023

In a deal brokered by the Swiss government, Switzerland’s largest bank will buy its smaller rival for about $3.2 billion.

Benzinga

AUGUST 14, 2024

FECM will advise technology industry clients in public merger, acquisition, and sale transactions and private debt and equity placements. The new capabilities offered by FECM are designed to better serve the growing needs of FE's technology sector entrepreneur, corporate, and investor clients.

NYT M&A

MAY 2, 2023

The largest bank is also the only one whose stability hasn’t been questioned. makes sure of that.

NYT M&A

APRIL 29, 2023

JPMorgan and PNC, two of the country’s largest banks, are said to be interested in acquiring the troubled lender after it is seized by the Federal Deposit Insurance Corporation.

NYT M&A

SEPTEMBER 12, 2022

The bank reported in July that its profit had fallen because of shakier economic conditions.

NYT M&A

MARCH 17, 2023

After a bailout from the biggest banks, the ailing midsize lender is searching for more help to shore up its finances and soothe the fears of investors and depositors.

NYT M&A

OCTOBER 5, 2022

Looming in the background of Mr. Musk’s $44 billion offer to buy the company is whether financing challenges will provide him with an escape hatch from a deal.

NYT M&A

AUGUST 31, 2023

The Swiss bank’s sharply discounted takeover of Credit Suisse led to a paper gain that gave it the biggest quarterly profit by a bank in history.

NYT M&A

FEBRUARY 8, 2024

Acquiring billions of dollars in assets from Signature Bank when it went under last year contributed to the Long Island lender’s troubles.

Global Finance

OCTOBER 31, 2024

The People’s Bank of China (PBoC) conformed by cutting mortgage rates, injecting cash into the banking system, and easing reserve requirements. Meanwhile, banks across the country are responding to difficult times with an unprecedented wave of innovation. trillion) in assets. trillion) in assets.

NYT M&A

APRIL 14, 2022

Elon Musk could pledge his Tesla shares, borrow from banks or team up with private equity to raise the funds. Each option comes with caveats.

NYT M&A

APRIL 24, 2023

Clients hurried to withdraw money as the Swiss bank faced collapse last month. It was eventually forced to sell itself to a rival, UBS.

Mckinsey and Company

FEBRUARY 29, 2024

After the 2023 spike in large deals and bank failures, the outlook for financial services M&A appears bright and active—particularly for acquirers with the skills to execute complex deals.

NYT M&A

JULY 15, 2024

The Wall Street investment bank earned $3 billion in the second quarter, more than double the tally from a year earlier.

NYT M&A

DECEMBER 28, 2023

Next year’s biggest headwinds for deal making will be “geopolitics, geopolitics and geopolitics,” says Viswas Raghavan, the co-head of global investment banking at JPMorgan Chase.

Benzinga

SEPTEMBER 9, 2024

Lehman was a first round investor in Mark Cuban's Broadcast.com, a partner in merchant bank Broadstream Capital Partners, and a seasoned investor, entrepreneur, and lifelong business leader. Lehman was the Founder, Chairman, and CEO of the largest radio network in the US, Premiere Networks (Nasdaq), which is now.

The Guardian M&A

NOVEMBER 8, 2022

This afternoon, FTX asked for our help,” tweeted Zhao. There is a significant liquidity crunch. To protect users, we signed a non-binding [letter of intent], intending to fully acquire FTX.com.”

The Guardian M&A

APRIL 21, 2022

Morgan Stanley, the US investment bank, is leading a group of financial institutions providing $13bn in debt financing. On top of that equity, Musk is raising a further $12.5bn for the offer via a margin loan secured against his shares in Tesla, the electric carmaker that he runs as CEO. Continue reading.

NYT M&A

AUGUST 2, 2022

It has tapped the investment bank Raine to assess its options, on the heels of a megadeal for another independent distributor, A24.

Sun M&A

APRIL 18, 2023

Availability of Additional Financial Resources Mergers and acquisitions may allow a company to access valuable assets or capital to expedite the growth plan. Since the company is larger, securing capital from banks or other available financial institutions may be easier.

Mckinsey and Company

FEBRUARY 19, 2025

In 2025, banking, wealth and asset management, fintech, payments, and capital markets face challenges but also have opportunities. In 2024, deals mostly stayed within national borders.

The Guardian M&A

OCTOBER 30, 2022

In the early 2000s AOL’s merger with Time Warner served notice that the dot-com boom was over. Royal Bank of Scotland’s over-priced takeover of ABN Amro was followed by the global financial crisis of 2008-09.

M&A Leadership Council

JULY 13, 2023

The Art of M&A® / Due Diligence: Precedent Transactions Analysis An excerpt from The Art of M&A, Fifth Edition: A Merger, Acquisition, and Buyout Guide by Alexandra Reed Lajoux Editor’s Note: A growing number of M&A professionals are pursuing the Certified M&A Specialist , or CMAS ® credential.

M&A Leadership Council

JULY 13, 2023

The Art of M&A® / Due Diligence: Precedent Transactions Analysis An excerpt from The Art of M&A, Fifth Edition: A Merger, Acquisition, and Buyout Guide by Alexandra Reed Lajoux Editor’s Note: A growing number of M&A professionals are pursuing the Certified M&A Specialist , or CMAS ® credential.

Benchmark Report

AUGUST 22, 2022

The firm remains ranked as the #1 Privately Owned Sell-Side M&A Advisors in the World and is ranked as the 10th Most Active Investment Bank in the United States. This ranking puts Benchmark International ahead of other well-known firms, including Morgan Stanley, Deloitte, Woodbridge International, and Bank of America Securities.

M&A Leadership Council

OCTOBER 2, 2023

The Art of M&A® / Integration: Closing An excerpt from The Art of M&A, Fifth Edition: A Merger, Acquisition, and Buyout Guide by Alexandra Reed Lajoux CLOSING What happens on the closing day itself? The Art of M&A, Fifth Edition: A Merger, Acquisition, and Buyout Guide.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content