Data Update 3: Inflation and its Ripple Effects!

Musings on Markets

JANUARY 27, 2022

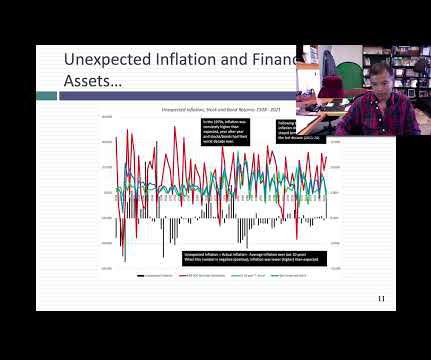

Interest Rates and Inflation Inflation and interest rates are intertwined, and when their paths deviate, as they sometimes do, there is always a reckoning. Put simply, no central bank, no matter how powerful, can force market interest rates down, if inflation expectations stay low, or up, if investor are anticipating high inflation.

Let's personalize your content