Data Update 3: Inflation and its Ripple Effects!

Musings on Markets

JANUARY 27, 2022

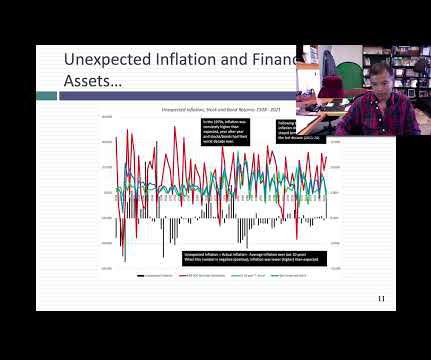

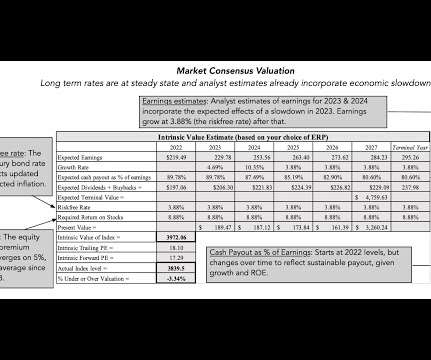

By the end of 2021, it was clear that this bout of inflation was not as transient a phenomenon as some had made it out to be, and the big question leading in 2022, for investors and markets, is how inflation will play out during the year, and beyond, and the consequences for stocks, bonds and currencies.

Let's personalize your content