Data Update 1 for 2025: The Draw (and Danger) of Data

Musings on Markets

JANUARY 10, 2025

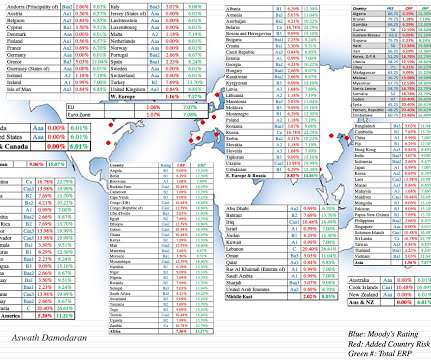

For the segment of my data that is macroeconomic, my primary source is FRED, the data set maintained by the Federal Reserve Bank , but I supplement with other data that I found online, including NAIC for bond spread data and Political Risk Services (PRS) for country risk scores. Beta & Risk 1. Return on Equity 1. Debt Details 1.

Let's personalize your content