Data Update 6 for 2023: A Wake up call for the Indebted?

Musings on Markets

FEBRUARY 27, 2023

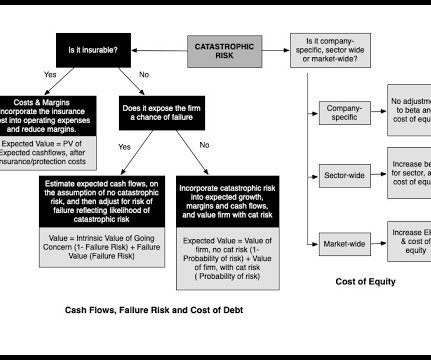

To fund the business, you can either use borrowed money (debt) or owner's funds (equity), and while both are sources of capital, they represent different claims on the business. Even government-owned businesses fall under its umbrella, with the key difference being that equity is provided by the taxpayers.

Let's personalize your content