Does the Market Misprice Companies’ “Strategic Alternatives” Announcements?

Reynolds Holding

FEBRUARY 5, 2023

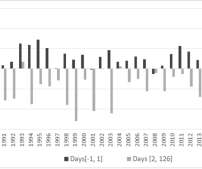

This is direct evidence that the announcement causes expectations of firm value to be biased upward. The subsamples with higher announcement returns, which reflect greater market expectations, experience negative future returns. The abnormal returns may be rational compensation for risk.

Let's personalize your content