Does the Market Misprice Companies’ “Strategic Alternatives” Announcements?

Reynolds Holding

FEBRUARY 5, 2023

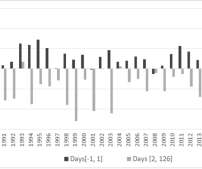

Firms seeking strategic alternatives may have confounding characteristics or experience other corporate events that also lead to low future returns. We find a negative and statistically significant alpha from our risk factor regressions, confirming our findings. Announcement returns and future returns, broken up by year.

Let's personalize your content