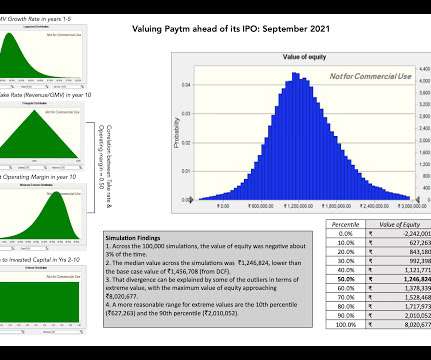

The Indian Smartphone Revolution: Paytm's Coming of Age IPO!

Musings on Markets

OCTOBER 4, 2021

Since so much of Paytm’s success has been driven by the rise if smart phone usage among Indian consumers, and the concurrent rise in mobile payments for goods and services, I will start with a review of that rise, before looking at how Paytm has put itself in position to take advantage of that market shift.

Let's personalize your content