Data Update 1 for 2025: The Draw (and Danger) of Data

Musings on Markets

JANUARY 10, 2025

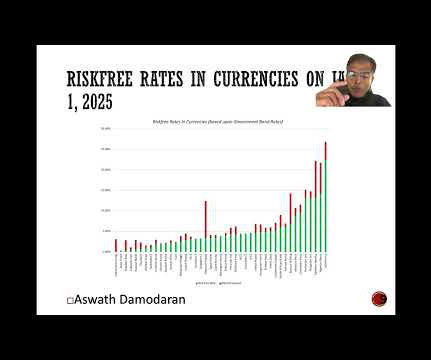

It is the end of the first full week in 2025, and my data update for the year is now up and running, and I plan to use this post to describe my data sample, my processes for computing industry statistics and the links to finding them. Beta & Risk 1. Equity Risk Premiums 2. Corporate Governance & Descriptive 1.

Let's personalize your content