Data Update 6 for 2025: From Macro to Micro - The Hurdle Rate Question!

Musings on Markets

FEBRUARY 8, 2025

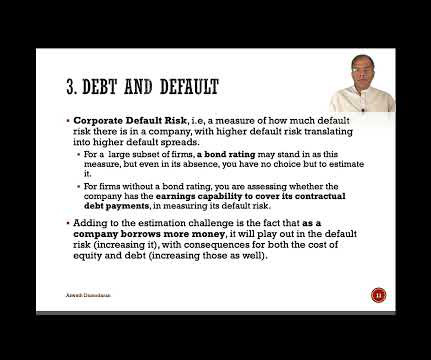

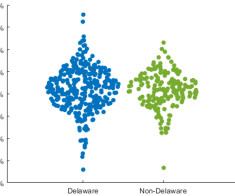

The Hurdle Rate - Estimation in 2025 With that long lead in, I will lay out the estimation choices I used to estimate the costs of equity, debt and capital for the close to 48,000 firms in my sample. In the context of checking to see whether a valuation passes the 3P test (Is it possible? Is it plausible? Is it probable?),

Let's personalize your content