Country Risk 2025: The Story behind the Numbers!

Musings on Markets

JULY 31, 2025

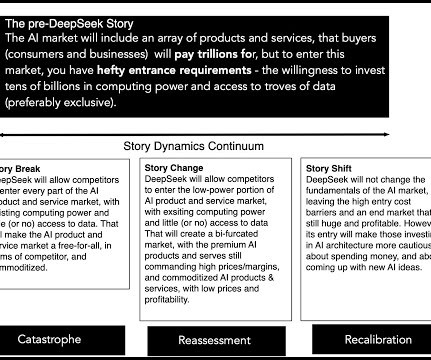

At the start of July, I updated my estimates of equity risk premiums for countries, in an semiannual ritual that goes back almost three decades. In May 2025, Moody's downgraded the United States, bringing them in line with the other ratings agencies; S&P downgraded the US in 2011 and Fitch in 2023.

Let's personalize your content