Data Update 6 for 2025: From Macro to Micro - The Hurdle Rate Question!

Musings on Markets

FEBRUARY 8, 2025

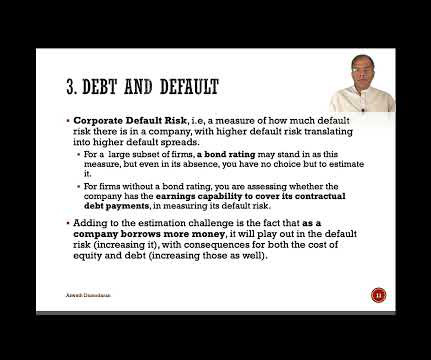

In data update 2 , I looked at equity risk premiums in the United States, and expanded that discussion to equity risk premiums in the rest of the world in data update 5 ). In data update 4 , I looked at movements in corporate default spreads during 2024. Corporate Default Risk , i.e,

Let's personalize your content