The Relevance of Historical and Forecast Periods in a Business Valuation

Equilest

JULY 20, 2025

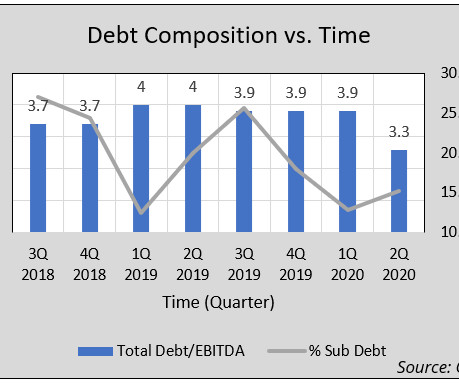

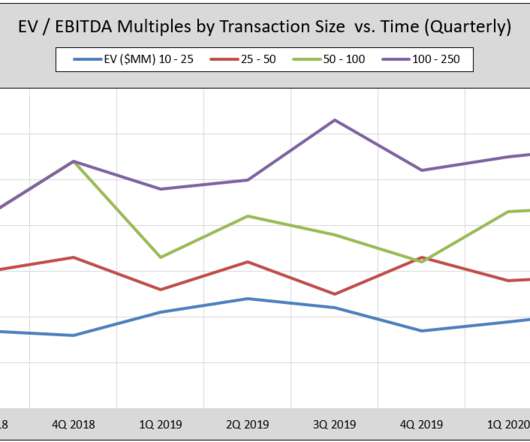

This guide offers a comprehensive breakdown , real-world numerical examples , and visual infographics to demonstrate the powerful role of historical and forecast data in determining enterprise value (EV) or equity value. ? 2018–2022) Year Revenue ($M) EBITDA Margin CapEx ($M) Working Capital ($M) 2018 8.0 3% 11% $22.9M

Let's personalize your content