Data Update 8 for 2025: Debt, Taxes and Default - An Unholy Trifecta!

Musings on Markets

FEBRUARY 23, 2025

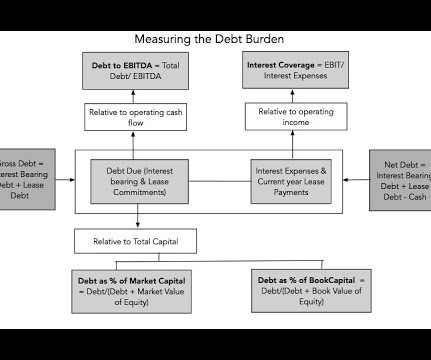

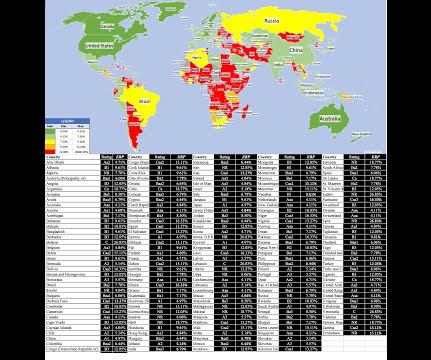

It was only in 2019 that the accounting rule-writers (IFRS and GAAP) finally did the right thing, albeit with a myriad of rules and exceptions. When the debt is within reasonable bounds (scaling up with the company), a company can borrow money, and not lower its ratings.

Let's personalize your content