Data Update 1 for 2024: The data speaks, but what does it say?

Musings on Markets

JANUARY 5, 2024

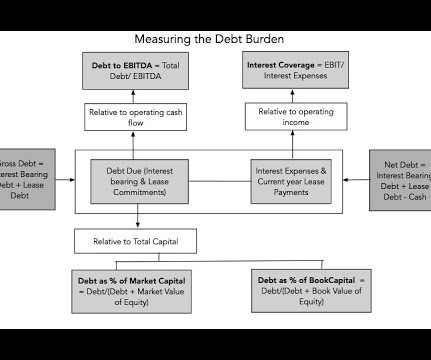

Thus, I have treated leases as debt in computing debt ratios all through the decades that I have been computing this statistic, even though accounting rules did not do so until 2019, and capitalized R&D, even though accounting has not made that judgment yet. Standard Deviation in Equity/Firm Value 2. Book Value Multiples 3.

Let's personalize your content