ESG Valuation Considerations – Top Down or Bottom Up?

Value Scope

JULY 21, 2020

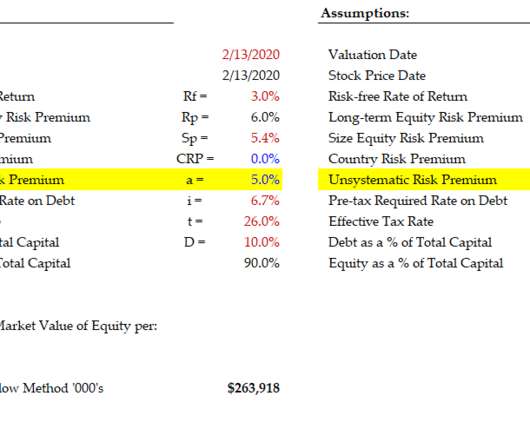

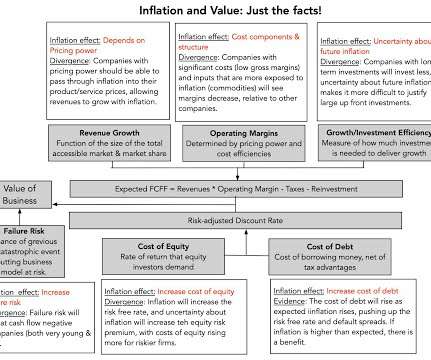

This work can be used to reconcile and support an adjustment to the CAPM, then the WACC, via Alpha and Beta. First, on December 17th, 2019, SEC Commissioner Hester Peirce went on live television to call for greater oversight of how ESG is used by companies and the investment community. “The Adjustments to Beta can accomplish this.

Let's personalize your content