Data Update 8 for 2025: Debt, Taxes and Default - An Unholy Trifecta!

Musings on Markets

FEBRUARY 23, 2025

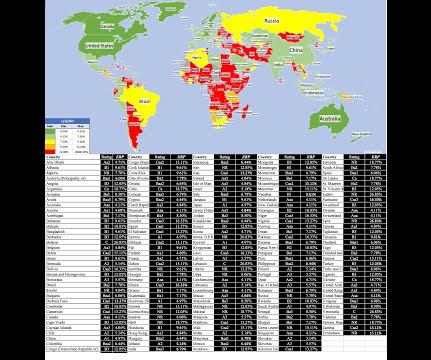

It was only in 2019 that the accounting rule-writers (IFRS and GAAP) finally did the right thing, albeit with a myriad of rules and exceptions. The default spread is a price of risk in the bond market, and if you recall, I estimated the price of risk in equity markets, with an implied equity risk premium, in my second data update.

Let's personalize your content