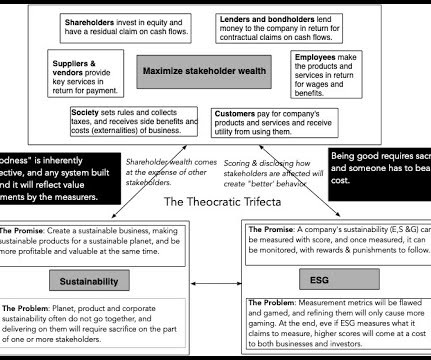

The Siren Song of Sustainability: The Theocratic Trifecta's Third Leg!

Musings on Markets

NOVEMBER 14, 2024

My voyage with ESG began with curiosity in my 2019 exploration of what it purported to measure, turned to cynicism as the answers to the Cui Bono (who benefits) question became clear and has curdled into something close to contempt, as ESG advocates rewrite history and retroactively change their measurements in recent years.

Let's personalize your content