What Is Seller Financing?

Benchmark Report

JULY 7, 2023

Seller financing is when the seller of a business acts as a lender to the buyer by offering financing for all or some of the purchasing price. The Buyer and Seller negotiate the terms of

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

what-is-seller-financing

what-is-seller-financing

Benchmark Report

JULY 7, 2023

Seller financing is when the seller of a business acts as a lender to the buyer by offering financing for all or some of the purchasing price. The Buyer and Seller negotiate the terms of

Viking Mergers

APRIL 3, 2023

After reviewing your finances, a financial advisor can tell you if your finances are sufficient and the timing is right for buying a business. It’s also helpful to research the current market and trends to see what industries expect growth in the upcoming years. What skills do I possess to run the business successfully?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Viking Mergers

MAY 19, 2022

Receiving the entire purchase price in cash at closing is, of course, the most straightforward and preferred option for the Seller. But there are business transaction structures where only part of the purchase price will be paid in cash, and the remainder will be paid via a Seller Note and/or an Earnout. What is a Seller Note? ,

Sun Acquisitions

MARCH 29, 2024

In the world of mergers and acquisitions (M&A), seller financing deals can offer numerous benefits to buyers. They provide a unique opportunity to secure funding from the seller, which can help bridge financial gaps and facilitate the purchase of a business.

Sun Acquisitions

FEBRUARY 20, 2024

Seller financing can be an attractive option for acquiring a business or real estate property. This blog post will explore the critical aspects of due diligence in seller financing deals and what buyers must know to ensure a successful transaction.

Harvard Corporate Governance

JANUARY 9, 2023

Economic stresses, uncertain financing markets and heightened regulatory scrutiny make it crucial for parties to conduct robust due diligence and negotiate deal terms to address downside and termination risks. Posted by Maxim Mayer-Cesiano, and Jonathan E. Berger is an Associate at Skadden, Arps, Slate, Meagher & Flom LLP.

Sun Acquisitions

FEBRUARY 12, 2024

Whether you’re a buyer or a seller, understanding the intricacies of various financing models is not just advantageous – it’s imperative. This article delves into educating buyers and sellers about financing models in business acquisitions. Let’s explore some of these models: 1.

Viking Mergers

MAY 17, 2022

We believe that a well-informed seller is better equipped to make the right choices for themselves and their business. Cash at closing is exactly that: it is payment the seller receives at closing. The most desirable and straightforward option for a seller would be to receive the entire purchase price in cash at closing.

Sun Acquisitions

FEBRUARY 28, 2024

However, mastering the art of business acquisition involves more than just signing a deal; it requires careful planning, tailored strategies, and astute financing choices. However, mastering the art of business acquisition involves more than just signing a deal; it requires careful planning, tailored strategies, and astute financing choices.

Sun Acquisitions

MARCH 8, 2022

One of the first questions a seller often asks is, “What documents are needed to sell a business?”. Seller’s Promissory Note for Financing. UCC Financing Statements. A follow-up question to “What documents are needed to sell a business?” What Does the Due Diligence Stage Involve? Escrow Agreements.

A Neumann & Associates

NOVEMBER 2, 2023

These 4 ingredients are essential for ultimate success: A Prepared and Motivated Seller – A fully motivated seller is the #1 most important ingredient needed for a successful sale of the business. Bottom line is that the seller must be “all in” or it is a doomed scenario.

IBG Business

FEBRUARY 6, 2024

Helping the seller anticipate and negotiate issues that can cause deviations from the expected sale proceeds can add unexpected value to involving an experienced M&A intermediary. Experienced buyers know precisely what they want to achieve in an acquisition. In a business sale, forewarned is forearmed.

Peak Business Valuation

APRIL 29, 2024

This occurs when one party (the seller) has more information than the other. The seller often understands the equipment’s condition and value better than the buyer. Inaccurate Financing: Third, financing equipment can be difficult, even impossible to obtain. Or, even struggle to secure financing in the first place.

Scott Mashuda

JULY 3, 2023

Whether you’re a buyer seeking a strategic acquisition or a seller looking to transition ownership smoothly, the search for the right party on the other side of the table is a crucial step. What does it mean to be a Qualified Buyer? What Should a Seller Look for in a Qualified Buyer??

Viking Mergers

MARCH 25, 2022

Accountant (an expert in taxes and financial details) Attorney (a legal expert) Business Broker (an expert in buying and selling businesses; this article covers more specifics about what a business broker will do). #2 Have a professional conduct a business valuation so you know what the range of value should be for your company.

IBG Business

JULY 5, 2023

In many business sales, the seller’s excitement at receiving a letter of intent from a prospective buyer can give way to disappointment, when they see that the proposed terms of the deal require the seller to finance a substantial portion of the purchase price. Seller Financing Pros and Cons Consider the “cons.”

Peak Business Valuation

APRIL 20, 2024

Business owners, sellers, lenders, and buyers all depend on this. What is an Automotive Equipment Appraisal? What Types of Automotive Machinery and Equipment Does Peak Appraise? It is what makes our equipment appraisal quick and efficient. This can help buyers and sellers make informed decisions.

Peak Business Valuation

FEBRUARY 3, 2024

Peak helps buyers, lenders, and sellers value equipment. What is an Auto Repair Equipment Appraisal? You may be buying, financing, or selling a business with auto repair equipment. What Types of Auto Repair Machinery and Equipment Does Peak Appraise? If it is too low, the seller leaves value on the table.

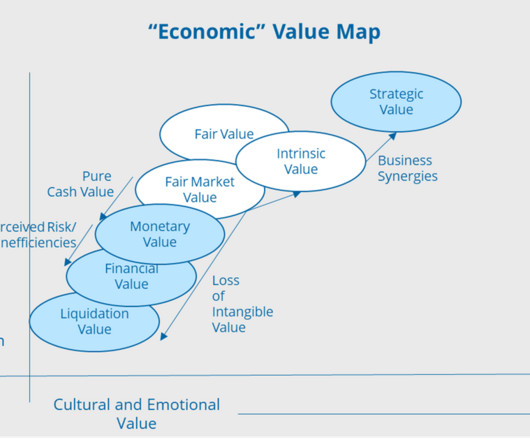

Value Scope

JUNE 2, 2021

Valuation necessarily requires an understanding and deep insight into accounting, economics, and finance. Now, statistical analysis, behavioral finance, and cultural economics are playing a more frequent role in valuation. The monetary value is just what it says, pure cash value without regard to any psychic benefits.

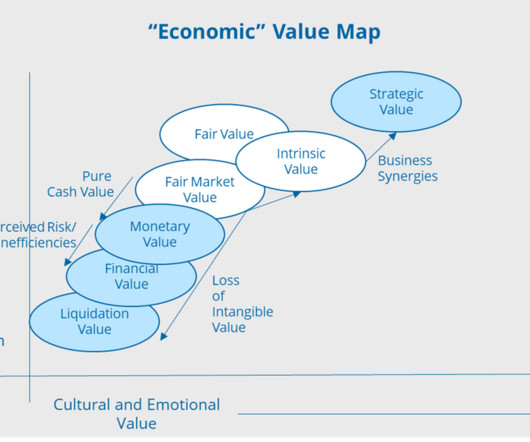

Value Scope

JUNE 2, 2021

Valuation necessarily requires an understanding and deep insight into accounting, economics, and finance. Now, statistical analysis, behavioral finance, and cultural economics are playing a more frequent role in valuation. The monetary value is just what it says, pure cash value without regard to any psychic benefits.

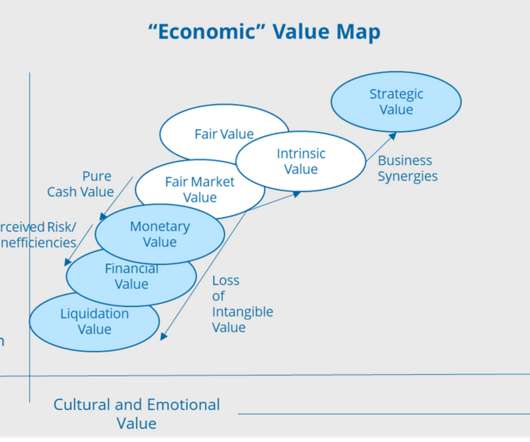

Value Scope

JUNE 2, 2021

Valuation necessarily requires an understanding and deep insight into accounting, economics, and finance. Now, statistical analysis, behavioral finance, and cultural economics are playing a more frequent role in valuation. The monetary value is just what it says, pure cash value without regard to any psychic benefits.

A Neumann & Associates

JANUARY 12, 2023

and one of the foremost respected M&A advisors on the East coast, says in his 2017 book entitled The Road Beyond – What Nobody Tells You About Selling a Midsized Business, “The transfer of a privately owned business is a very complex transaction with many considerations, elements and factors to be taken into consideration.

Sun Acquisitions

MARCH 6, 2024

Negotiating Interest Rates Interest rates play a pivotal role in the financing of a business acquisition. Knowing the market norms will help you gauge what’s reasonable. Multiple Financing Options: Don’t put all your eggs in one basket. Multiple Financing Options: Don’t put all your eggs in one basket.

Peak Business Valuation

FEBRUARY 19, 2024

Obtaining a trucking appraisal provides strategic direction that is essential for buyers , sellers , lenders, and truck owners. What is a Trucking Equipment Appraisal? Their goal is to offer valuable insights for buyers, sellers, lenders, and trucking business owners. Truck appraisals don’t tell you what to do.

A Neumann & Associates

JULY 5, 2023

Have you heard that at any given time, a business owner knows precisely what his or her business is worth and sells for? The value of the business will be driven by the seller’s financial records, the target market, and the marketing strategy. It is vital that sellers continue operating their business as though it may never sell.

Sun Acquisitions

MARCH 26, 2024

This guide provides insights to what HVAC sellers can expect. Many times, sellers will select a buyer based on criteria other than just having the best price. The post What to Expect in the Sale of an HVAC Company appeared first on Sun Acquisitions | Chicago Business Broker and M&A Firm.

Sun Acquisitions

JANUARY 26, 2024

I was open minded to either: Selling and retiring or Selling and staying on to build a bigger business What was the sale process like? Due diligence was faster than promised, since our buyer did not require financing. Sun screened over 100 buyers and we had buyer/seller calls and meetings with a handful of select buyers.

Benzinga

MAY 18, 2022

What Happened: Musk was apparently in a hurry to get the deal done and suggested on April 21 that his acquisition proposal was "no longer subject to the completion of financing business due diligence," preliminary proxy statement filed by the social media platform ahead of the special meeting of shareholders said.

Peak Business Valuation

APRIL 25, 2024

We assist buyers , sellers , and lenders in obtaining an industrial equipment appraisal. What is an Industrial Equipment Appraisal? Buyers can understand what they are walking into before committing to a price. Sellers can minimize the risk of undervaluing or overvaluing their industrial equipment.

A Neumann & Associates

OCTOBER 12, 2023

In the world of mergers and acquisitions (M&A), success hinges on the ability to connect the right buyers with the right sellers. Enhanced Confidentiality: By not adequately screening investors and disclosing the seller’s identity to a wide number of investors, confidentiality can be breached with negative impact on the business.

Peak Business Valuation

FEBRUARY 29, 2024

What is a Mining Equipment Appraisal? What Types of Mining Machinery and Equipment Does Peak Appraise? Below are a few examples of what mining equipment our team appraises. Buying or Selling Mining Equipment First, mining equipment appraisals help buyers and sellers conduct successful business transactions.

A Neumann & Associates

MAY 7, 2024

The second most common question that we are asked by business owners is “what type of Buyer would be interested in my business?” Note: The most common question is “what do you think my business is worth?” It is about matching up Buyers and sellers, based upon their core attributes and motivations, which we do every day.

Peak Business Valuation

MARCH 29, 2024

To help, we offer tailored solutions to buyers, sellers, and lenders. What is a Freightliner Trucking Appraisal? What Freightliner Trucks Does Peak Appraise? For sellers, an accurate appraisal helps to determine the truck’s fair market value. This is where accurate trucking appraisals play a crucial role.

Scott Mashuda

OCTOBER 17, 2023

Despite headlines suggesting a slowdown, better metrics are needed to paint an accurate picture of what is actually happening in the lower middle market (LMM). In Q2 of 2022, interest rates started to creep up as the Fed hoped to cool down what was a white-hot inflationary market. What Should We Expect From Valuations?

Peak Business Valuation

FEBRUARY 7, 2024

This is beneficial whether you are buying , financing , or selling textile equipment. We tailor our machinery and equipment appraisals to buyers, sellers, and lenders. What is a Textile Equipment Appraisal? This is especially relevant when buying , selling , or financing textile equipment. Schedule a Free Consultation!

RC & Co.

FEBRUARY 6, 2022

Due diligence covers many areas of a company from finance to HR to IT and everything in between. But what about the seller? The first block (moving left to right) of items to be performed by a seller to prepare for going to market calls for due diligence to be undertaken. Our go-to source for such information is TagniFi.

Sun Acquisitions

JANUARY 24, 2022

Knowing what to look out for during due diligence and surrounding yourself with a team of trusted M&A advisors can help offset the inherent dangers with mergers and acquisitions. It requires an entire team to stand with the buyer and the seller as they assess the deal from every angle. Are they allowed to take over the contract?

Peak Business Valuation

APRIL 8, 2024

In this article, we explain the what and why behind office equipment appraisals. What is an Office Equipment Appraisal? Why can’t you just estimate the value based on what you bought it for? What Types of Office Equipment Does Peak Appraise? This is true whether you are buying , selling , insuring, or lending.

A Neumann & Associates

MAY 10, 2023

What happened? These can exist on the Buyer’s, or Seller’s side and most can be avoided or mitigated by doing proper preparation before a business is listed, engaging the right M&A Advisor, and successfully completing the steps that follow signing an Offer to Purchase. Life is Good!

Peak Business Valuation

MARCH 15, 2024

Our team helps buyers , sellers , and lenders who are valuing a concrete business or valuing concrete equipment. What is a Concrete Equipment Appraisal? What Types of Concrete Machinery and Equipment Does Peak Appraise? Are you a buyer, seller, or lender? Our safety and success depends on its stability.

Scott Mashuda

NOVEMBER 13, 2023

The Rising Cost of Debt: What this means for Entrepreneurs The cost of debt, encompassing interest payments and associated expenses, is a critical factor that influences a company’s financial decisions. What is the Impact of Valuations on Financial Multiples? What is the Impact of Valuations on Financial Multiples?

Peak Business Valuation

MAY 3, 2024

What purpose does a construction business valuation serve? This enables both buyers and sellers to make informed decisions. To stay on top of the game and know what to focus on, obtain a construction business appraisal. Some are looking for a profitable exit. Others seek freedom to focus on new ventures and interests.

Peak Business Valuation

APRIL 9, 2024

Equipment fair value is critical for buyers , sellers , lenders , and owners to understand. What is a heavy truck appraisa l? What is a Heavy Truck Appraisal? On the other hand, sellers can use this type of appraisal to set a competitive yet reasonable asking price. When should I obtain one? Schedule a Free Consultation!

Viking Mergers

MARCH 8, 2023

They believe they’ve found the perfect business; financing has been approved; they’re weeks into due diligence, and “Surprise!” What Kind of Issues Might Scare Away Buyers? First, let’s cover what constitutes a “major issue” that could potentially scare away buyers. Today’s focus is Deal Killer #2: Unresolved Issues.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content