The Evolution of ESG Reports and the Role of Voluntary Standards

Harvard Corporate Governance

NOVEMBER 21, 2022

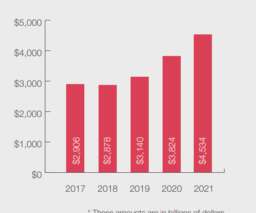

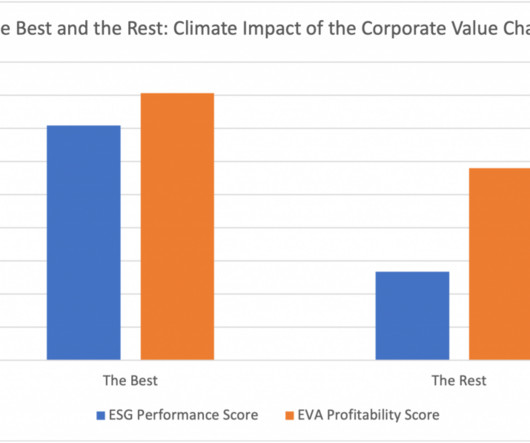

At the start of the 21st century, almost no companies released ESG-related disclosures, but by 2021, most large publicly traded U.S. In our paper , we examine the evolution of ESG reports for S&P 500 companies and explore how the content of ESG reports has evolved in the absence of regulation. Our Findings.

Let's personalize your content