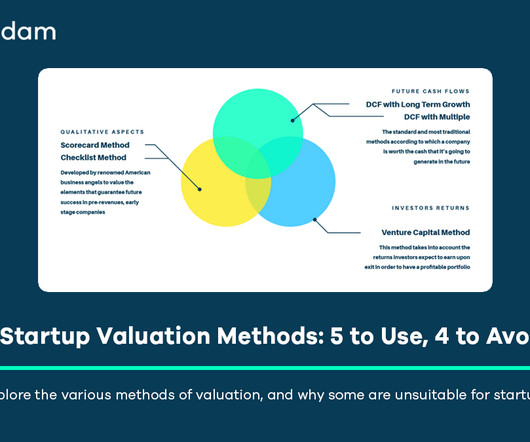

9 Startup Valuation Methods: 5 to Use, 4 to Avoid

Equidam

APRIL 26, 2025

This approach encourages dialogue focused on the business fundamentals the team, the market opportunity, the product, the financial projections rather than anchoring the conversation to arbitrary figures potentially derived from selectively chosen, and often inappropriate, market comparisons.

Let's personalize your content