Discount Rate—Explanation, Definition and Examples

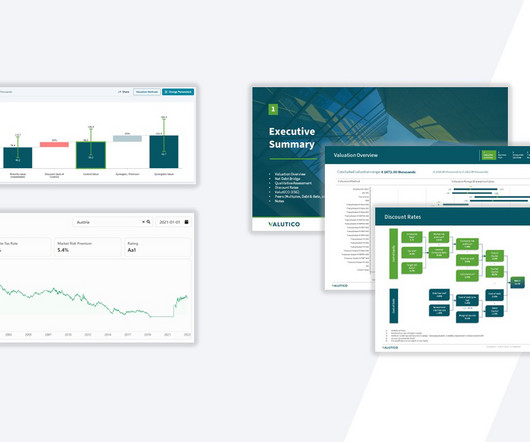

Valutico

FEBRUARY 27, 2024

The formula for WACC is: WACC = (E/V x Re) + ((D/V x Rd) x (1-T)) E = market value of equity D = market value of debt V = total market value of the firm’s equity and debt Re = cost of equity Rd = cost of debt T = tax rate Check out more insights on the concept of WACC here.

Let's personalize your content