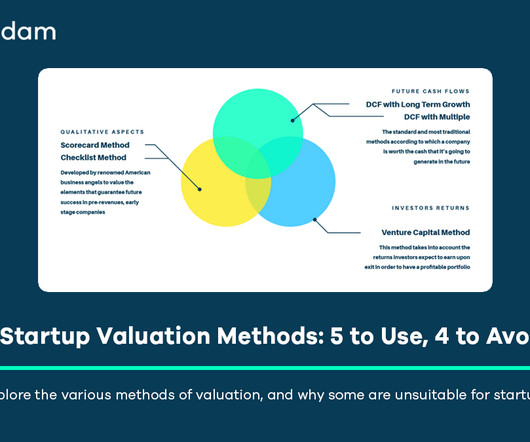

9 Startup Valuation Methods: 5 to Use, 4 to Avoid

Equidam

APRIL 26, 2025

a 409A valuation in the US), planning exit strategies, and informing overall business planning. High failure rates are a stark reality in the startup world, adding another layer of risk that must be accounted for. However, particularly for early-stage ventures, valuation presents unique challenges.

Let's personalize your content