Risk Capital and Markets: A Temporary Retreat or Long Term Pull Back?

Musings on Markets

JULY 1, 2022

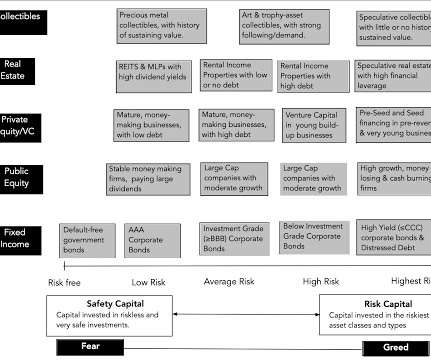

And Consequences If you are wondering why you should care about risk capital's ebbs and flows, it is because you will feel its effects in almost everything you do in investing and business. That pullback has had its consequences, with equity risk premiums rising around the world.

Let's personalize your content